DeFi Options Comparison.

Options.

Welcome to all our new subscribers! Please forward today's note to a friend, neighbour, colleague, frenemy, or in-law to spread the word. And for those who missed last week's episode, you can find it here. TLDR below. This is not financial advice.

Economics of tokenisation and ecosystem is free weekly in your inbox. Please share it with anyone that can benefit from this knowledge.

General Conclusion

Introduction

Options are structured products used in financial markets used as a hedge against volatility, a tool for speculation or a way to get exposure to an asset with better capital efficiency. Either way, options are increasingly seen as an attractive financial asset, especially after the Gamestop saga.

In the DeFi space, options are only just entering the market. Opyn was the first of its kind to develop a decentralised options protocol. Hegic followed after, attracting liquidity very quickly. Both are innovative in their own ways, and there are continuous developments in the options space.

As DeFi users are more comfortable with the new tools and mechanisms, the next step is to think of risk management in trading as well as capital efficiency. Both can be achieved with options. Hence, the mechanisms behind options protocols, in terms of pricing premiums and other risk management, are very attractive for people who see inefficiencies in the existing system.

In this article, we will analyse 4 protocols — 2 core protocols (Opyn and Hegic) and 2 other protocols (Dopex and Whiteheart). Specifically, we will analyse the 5 factors:

how the protocol works in general

how premiums are calculated

purpose of the native token

the benefit of holding the native tokens

Whiteheart works automatically by buying an at-the-money (ATM) put option contract on the user's behalf each time the user acquires an asset on a DEX.

Summary

Opyn

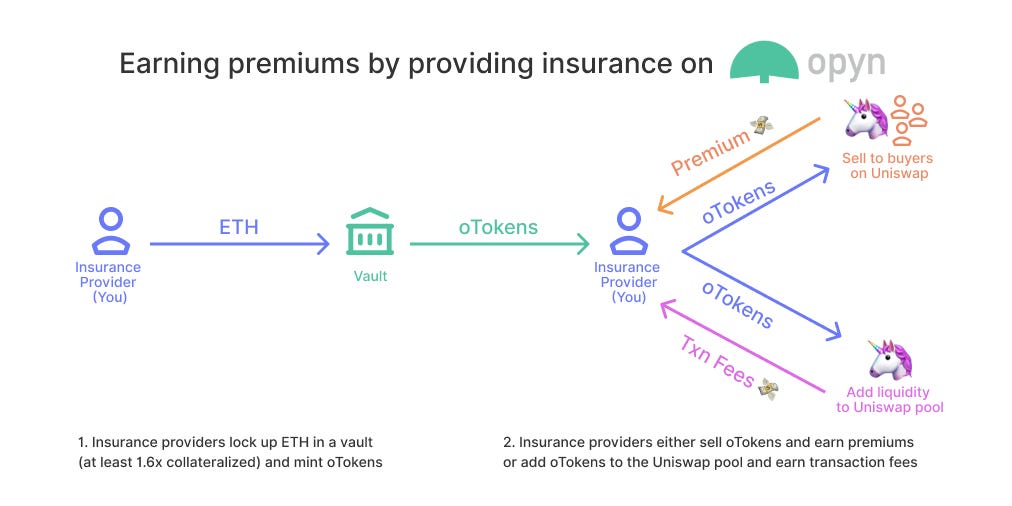

Opyn is the original DeFi options platform, built with the Convexity Protocol. Users can create a call and put options using the protocol. Anyone can buy options ($oTokens) to protect themselves against DeFi risk. In V1, users deposit collateral into a vault to mint and sell $oTokens, and receive a premium from protecting others. Prices are calculated using the Black Scholes model. In V2, users price their options independently, thus allowing variables like gamma, vega and implied volatility to be created. $oTokens are also traded in secondary markets like Uniswap. Opyn does not charge fees.

Check out our full analysis on Opyn's economic model.

How Does Opyn Work?

Source: opyn.co

Create Options ($oToken)

The seller has to open a new vault firstly + add collateral + issue $oToken. Premiums are paid to the seller and determined by the Black-Scholes formula below or Txn Fees.

Maintain enough collateral in the vault To ensure that the number of $oToken cannot sell more options than it can afford, each seller needs to have enough collateral to match the number of options (at least 160% collateralised). Each vault needs to meet the minimum mortgage requirement.

Liquidate subprime collateral vaults Any vault that does not meet the minimum collateral is subject to a partial or full bar of assets in it. Anyone can exercise this right as a reward.

Exercise rights $oToken holders can exercise the right to sell their asset for the strike price at maturity if it has benefit. Or the seller can redeem all their collateral. If a hack/disaster detected, $oToken holders can exercise right, make a claim and immediately get paid out from vaults.

Hegic

Hegic is a peer-to-pool option trading protocol that allows users to trade in options in a decentralised way. Users deposit assets ($ETH) into a vault, which automatically becomes an option seller. Users purchase options via the vault directly, paying a premium calculated with the Black Scholes model. Upon settlement, a fee of 1% of the options contract is payable to $HEGIC stakers on the platform.

Buyers and sellers receive $HEGIC. They can stake $HEGIC to receive settlement fees when options are settled at or before expiry.

Check out our full analysis on Hegic's economic model.

How Does Hegic Work?

Hegic works quite simply with the participation of two components, writers and buyers:

Buyers: who need to call or put option on Hegic. Buyers can customise parameters of Options such as expiry date, strike price.

Writers: Who sell call or put options to make a premium and to become a writer on Hegic users simply need to provide liquidity to the Hegic Pool.

$HEGIC holders: Who will earn premium and settlement fee from all transactions on platform.

Source: Hegic.co

Dopex

Dopex is a decentralised options protocol which combines great advantage from Uniswap, UMA, Opyn to make products and synths better. Dopex is also set to earn yield, which brings benefits to participants. This makes Dopex a Dex with many functions.

How Does Dopex Work?

Dopex options are called $rDPX and can be traded on AMMs such as Uniswap, Dopex liquidity pools and OTC gateways, as well as centralised exchanges in futures treat them as ERC20 — instant adaptability exchange for $rDPX.

Whiteheart

Whiteheart is a protocol built on top of Hegic, using the composability feature of DeFi. As users add their assets into the vault, an automatic ATM put option at bought with a <1% spread. This is to protect liquidity providers from downside risk. Think of it as insurance automatically included for liquidity providers.

How Does Whiteheart Work?

Whiteheart works automatically by buying an at-the-money (ATM) put option contract on the user's behalf each time the user acquires an asset on a DEX.

These options are purchased on Hegic Protocol.

What Else Did You Miss?

How Are Opyn’s Premiums Calculated?

The Opyn’s Native Token

How Are Hegic’s Premiums Calculated?

$HEGIC

Purpose Of $HEGIC

Benefit Of Holding $HEGIC

How Are Dopex’s Premiums Calculated?

$DPX

Purpose Of $DPX

Benefit Of Holding $DPX

$WHITE

Purpose Of $WHITE

Benefit Of Holding $WHITE

Get premium access to unlock more content

TLDR:

Ps: Order the textbook "Economics and Math of Token Engineering and DeFi" today!