The Economics of Play to Earn (P2E) Markets

A Comprehensive Framework for Designing Robust and Sustainable Play-to-Earn (P2E) Economies

Introduction

Economics forms the backbone of any market, whether it be a decentralised finance (DeFi) economy, play-to-earn (P2E) ecosystem, or even a country. The success of these systems relies heavily on getting the economics right. Building a robust and balanced economic system requires careful consideration of various parameters and incentives for different economic agents within the market. However, it is a challenging task that requires a deep understanding of the underlying principles. To provide a starting point for designing P2E economies, this article offers a comprehensive framework to define parameters and considerations.

We will explore the various components of P2E economics and discuss how they contribute to the organisation and coordination of different agents within a virtual space. By understanding the framework and applying it to real-world examples like Axie Infinity, we can gain insights into designing robust and sustainable economies.

Key topics this article will cover:

Why do markets exist?

Economics design framework for P2E economic models

Value creation cycle in P2E Economics

Case Study: Axie Infinity

Conclusion

Why do markets exist?

Markets exist primarily to create value by reducing transaction costs. They facilitate the matching of different economic agents for trade and transactions, providing an efficient and effective environment for value exchange. Value is realised when the cost of searching for a transaction partner is minimised in terms of time, energy, and effort. In addition, value retention depends on well-defined transaction rules and governance mechanisms. Establishing clear rules and regulations for transactions is crucial for maintaining a robust and sustainable market.

Economics design framework for P2E economic models

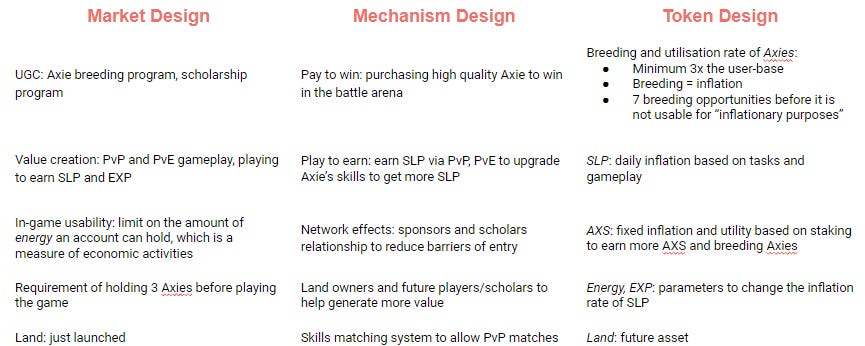

The framework for designing P2E economies revolves around three core pillars: market design, mechanism design, and token design. Each pillar entails specific considerations and parameters that shape the overall economic system.

Market Design

Market design involves defining the parameters and constraints within the virtual world, including the different economic agents, transaction pathways, and activities. In the context of P2E, market design encompasses user-generated content (UGC), non-fungible tokens (NFTs), and in-game usability. Understanding the value creation potential of each economic agent and aligning their incentives is crucial for a thriving economy.

Mechanism Design

Mechanism design focuses on establishing rules and governance models that govern user interactions and transactions within the market. These rules can be implemented through smart contracts, legal agreements, or other forms of enforcement. By aligning the behaviour of economic agents with the desired outcomes, mechanism design ensures a smooth and efficient functioning of the ecosystem. It encompasses aspects such as governance models, revenue models, and network effects. Balancing these factors is essential to create a sustainable and thriving P2E environment.

Token Design

Tokens play a vital role in P2E economies, representing various forms of value. While tokens can include in-game currencies like $AXS or $SLP, they can also extend to other forms of value representation. Token design encompasses aspects such as monetary policy, inflationary and deflationary pressures, and capturing intrinsic and extrinsic value. Balancing these elements is essential for maintaining a robust and sustainable economic system.

To simply put, the economics design framework helps economists, creators, and designers build sustainable economies. It includes market design, mechanism design, and token design. Market design sets parameters for mechanism and token designs. Mechanism design creates rules for transactions between players and determines how players earn in-game. Token design converts value into rewards for users. By utilising this framework, creators can optimise economies to promote sustainability, user engagement, and value creation.

Value creation cycle in P2E Economics

The value creation cycle consists of 3 components, creation (inflation), distribution, and sinks (deflation). Balancing these aspects is crucial for sustainable growth and long-term success.

Value creation (inflation): long-term productivity growth and structural transformation

Value distribution: short-term balance of economic growth and asset inflation

Value sinks (deflation): real value growth of active player class, coming from supply reduction of asset

Whilst the primary focus of most projects lies in value creation and distribution, it is crucial to recognize the significance of value sinks in fostering a healthy and balanced economy. Value sinks represent the real value growth of the active player class and are derived from the reduction of asset supply. This component emphasises the significance of limiting asset availability to stimulate demand and foster value appreciation, enabling active players to accrue significant gains. Without effective management of value sinks, an economy can become imbalanced, leading to inflationary pressures, overvaluation of assets, and ultimately, instability. By prioritising value sinks alongside creation and distribution, projects can promote a robust and sustainable value creation cycle that supports long-term growth, equitable distribution, and prudent asset management.

Case Study: Axie Infinity

To provide practical context, let's examine the P2E game Axie Infinity. This popular NFT-based game allows players to trade, breed, and battle with unique creatures called Axies. By analysing the market design, mechanism design, and token design within Axie Infinity, we can gain insights into how these concepts are applied in a real-world scenario. This case study demonstrates how the framework can be utilised to build a successful P2E economy.

Token design and economic considerations

Token design plays a vital role in shaping the Axie Infinity economy. The game features multiple tokens, each serving a distinct purpose:

Axies (NFTs): Axies are the core NFTs representing the digital creatures in the game. The breeding of Axies helps manage inflation, with each Axie capable of breeding up to seven times before reaching its reproductive limit. The minimum requirement of three Axies per user ensures a baseline value for the tokens.

Smooth Love Potion ($SLP): $SLP is an in-game token used as a reward system to incentivize players for various activities. Balancing the inflation rate of SLP becomes crucial to maintain economic stability and motivating desired gameplay behaviours.

Axie Infinity Shards ($AXS): $AXS serves as a governance token, allowing holders to participate in decision-making processes. Stakeholders can earn additional AXS by staking and breeding Axies.

Energy and EXP: Energy and EXP tokens are used to manage the inflation rate of $SLP. Tweaking these variables affects the inflation rate, thereby shaping the value of $SLP and maintaining its sustainability.

Land: The recent introduction of Project K allows players to acquire and develop land in the Axie Infinity metaverse. Enhancing the land mechanics contributes to the overall economic framework.

Defining the market and understanding personas

To design a robust economy, it's essential to understand the different participants or personas involved. In the case of Axie Infinity, five key personas emerge: players, builders, developers, investors, and NFT collectors. Each persona brings unique value and creates economic activity within the game. By analysing their incentives, contributions, and available resources, Axie Infinity can shape its economic policies and mechanisms to maintain a healthy balance.

Mechanism design in Axie Infinity

Mechanism design in Axie Infinity involves establishing rules for gameplay, user-generated content creation, and revenue models. The game utilises a scholarship program, allowing players to rent Axies from investors or sponsors. Additionally, builders can purchase land plots to create unique gameplay experiences within the metaverse. Token design in Axie Infinity encompasses the monetary policies of $AXS and $SLP. $AXS has a minimum ownership requirement of three per user, ensuring a bottom floor price based on the user base. Breeding Axies introduces controlled inflation, allowing for a manageable supply of NFTs. $SLP serves as an incentive for desired behaviours, encouraging players to participate in gameplay activities and fostering user retention.

Balancing user growth and inflationary pressures

Axie Infinity faces the challenge of balancing user growth with inflationary pressures. As the user base expands, more $SLP is generated, leading to potential inflation. At the same time, the breeding of Axies affects the inflation of $AXS. Achieving a balance between these two factors is crucial to sustaining the ecosystem. The incentive structure needs to align with the growth of the user base while managing the inflationary pressures on tokens.

Value creation and distribution

Value creation in Axie Infinity involves two main activities: player versus environment (PvE) and player versus player (PvP) gameplay. PvE tasks incentivize players to engage with the game regularly, while PvP matches utilise players' skills and strategies. Balancing these activities is crucial to keep players engaged while ensuring sustainability. Moreover, value distribution considers factors such as the inflation rate of $SLP and the breeding rates of Axies, which impact the overall economy.

The role of value sinks and deflationary pressures

To maintain a healthy economy, value sinks and deflationary pressures are crucial. Value sinks help reduce token supply, increasing their scarcity and value. Implementing deflationary measures, such as burning tokens or increasing utility, can ensure that the real value of assets grows. Balancing inflationary and deflationary pressures is essential to increase the real value of tokens, benefiting players and creating a sustainable ecosystem.

Conclusion:

Designing a thriving and sustainable P2E economy is a complex task that requires careful consideration of market design, mechanism design, and token design pillars. By understanding the principles and parameters within each of these areas, builders and developers can create a vibrant and balanced economy. The framework presented in this article provides a comprehensive starting point for designing and understanding P2E economics. By considering market design, mechanism design, and token design, stakeholders can navigate the complexities of virtual economies more effectively. The case study of Axie Infinity showcases the practical application of the framework in a popular P2E game.

As the P2E ecosystem continues to evolve, a well-designed and balanced economic framework becomes increasingly crucial for sustainable growth and user engagement. While this article provides a simplified overview, exploring our detailed research and resources can offer a more comprehensive understanding of P2E economics. With a solid foundation in these principles, you can confidently embark on building your own successful P2E ecosystem.

Do you need help in creating a sustainable economy for your NFT game? The team at Economics Design offers tokenomics consultancy for builders, and an advanced Token Economics 201 course for aspiring economists looking for advanced assistance with token economics design and token engineering. Don't settle for subpar token economics – choose Economics Design and take your game to the next level!

Don’t forget to like and subscribe so you don’t miss out on important updates and our newly uploaded podcasts.