Ep 35 What is volatility and how it affects crypto

Market Volatility and Implied Volatility.

Welcome to all our new subscribers! Please forward today's note to a friend, neighbour, colleague, frenemy, or in-law to spread the word. And for those who missed last week's episode, you can find it here. TLDR below. This is not financial advice.

Catch the episode on YouTube

Economics of tokenisation and ecosystem is free weekly in your inbox. Please share it with anyone that can benefit from this knowledge.

General Conclusion

2 types of volatility — external volatility (aka market) and implied volatility (aka internal). They are useful factors when understanding your assets.

FactorsBeyond Volatility

Volatility is not the only thing you should care about when looking at your (crypto) assets. Also note the other data and factors.

Micro Economy: Inflation of assets

Macro Ecosystem: Market Conditions. Market could change and that affects the assets.

Past Data: Beyond micro and macro markets it's also good to look at historical data to look at past data to get some reference and understanding. Note: Past data does not define future performance

Historical Volatility vs Implied Volatility

There are two types of volatility. One is the market volatility and the other is implied volatility. In a very simple way it's basically historical volatility and future volatility.

Historical volatility: It is based on past data and on all the information that is already given.

Future volatility: It is based on people's expectations of the assets and here you calculate based on how people pay for the expected assets.

Higher Volatility = Higher Risk

The general notion about volatility is that higher volatility = high risk.

Sometimes it is called educated gambling or educated speculation but it's not always true. The general notion of higher volatility means that the price will move more and when the prices move more, higher risk will be experienced. But it really depends on the trading strategy because that will help to mitigate different risks as when you have something with high volatility you can do something else to try and offset the risk or try to reduce that risk.

What is Market Volatility?

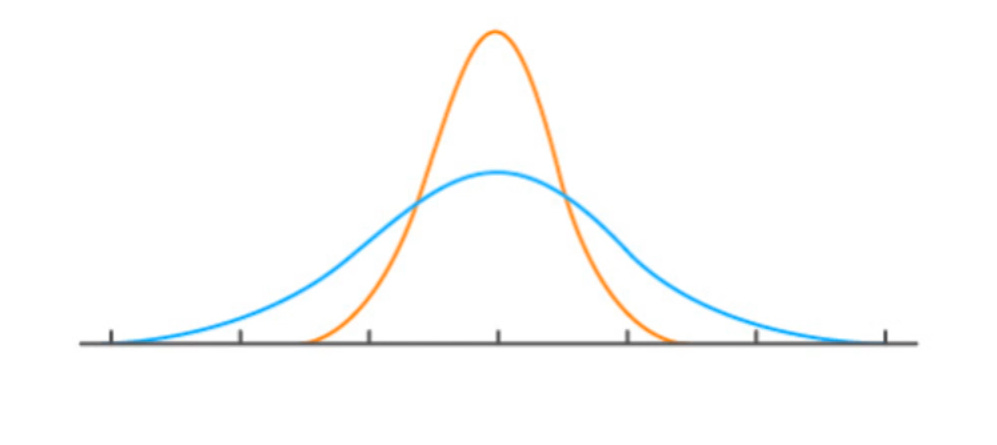

It's a statistical measure of how "spread" is the value from the middle average. More spread (like a pancake) means higher volatility. Less spread (like a mountain) means lower volatilty.

Uses Past Data: It's historical volatility or using past data to get some understanding of where the asset is right now.

Fluctuation of Returns: It is the fluctuation (movement) of the returns of the prices of the assets. It is measured by measuring the spread of the returns so you can think of it as two bell curves. One bell curve is flat so almost like a very low middle line and it spreads out very widely like a pancake. You have another bell curve like the Mount Everest so it has a very high peak and everything is very narrow towards the peak.

Higher Volatility: Volatility is the spread of the value of the assets so when it's more pancake shape (i.e. when the sides are more spread out into different directions) that's where it's more volatile. Because there are more ways the spread could go.

Whereas if it's higher like a mountain (i.e. when it's very narrow towards the center ), then there is low volatility because the prices won't change so much and it's all within a very constrained range.

(ELI5) How to Read Charts: High vs Low Volatility

This chart is about the prices of bitcoin in the past 180 days.

In July, The price moved very little and always hovered below 10,000.

In the august period it moved quite a bit but the candle charts didn't move as significantly as earlier.

From September to mid-October it also moved a bit which can be seen in the candle chart.

In November, December and January, huge movement or huge candle charts can be seen. Which tells us how volatile the asset is relative to the entire the asset in the long run.

Volatility is really just comparison and you can't say something is volatile without comparing it to something else.

It can either be compared to its past data or some other asset or benchmark. So let's say we compare bitcoin six months ago to bitcoin today:

Six months ago was low volatility and right now it's high volatility because prices change so much which can be seen in the candle chart. That is comparing the asset to itself.

Now let's look at comparing the asset to another asset or another benchmark. That would be the other chart which is the pancake-shaped bell curve versus the mountain-shaped bell curve.

The pancake-shaped bell curve is where it's higher volatility because prices can spread out a bit more and the spread is much wider versus the mountain-shaped which is low volatility and the shape is going more towards the middle line.

Why do we care?

These values give us two main information:

Market sentiment: It is something like the better volatility where we try to figure out what the market is thinking about and how it compares to other assets

Historical spot price: It is how the asset itself is doing

We use the information to make bets with it or to hedge against the future

What Else Did You Miss?

What is implied Volatility?

The Black-Sholes Formulas

Measuring Implied Volatility (IV)

Valuing IV

Speculate/Bet on Volatility Movement

When do we see High Volatility?

When do we see Low Volatility?

Ways to hedge Volatility

Futures Contract

Swap Contract

Option Contract

Using Option in Crypto Finance

CeFI

DeFi

Get premium access to unlock more content

Listen on podcast if you prefer audio version.

TLDR:

Option contracts are a way to hedge against volatility (price movement) in the market. Other ways include futures contract and swapping.

In general, higher volatility means higher risk because prices move more. That affects people's demand for option prices. Form options contracts, we can also tell how bullish or bearish the market is.

Get smart: Options are a tool that can be used to hedge against risks or to bet in the market. Difficult tool, but powerful when used right.

Get smarter: CeFi options for crypto exists. And DeFi options protocols are coming right up.

Ps: Order the textbook "Economics and Math of Token Engineering and DeFi" today!

Awesome article, easy to understand!