EP 43: Economic Value of NFT

Overview about NFT.

Welcome, premium subscribers! Thank you for subscribing.😘 TLDR below. This is not financial advice.

Catch the episode on YouTube

Introduction

In the past, there was almost no cost involved in creating an item in the digital world. As a result, these items have become worthless because they are not difficult to create or reproduce/duplicate.

With the advent of blockchain, scarcity in the digital world was created and it connected a part of the real world to the virtual world.

NFT is one of the key foundations of the new digital economy, powered by blockchain. NFT has been tested in areas such as gaming, digital identity, licensing, certification and fine arts. Users can even split and proportionally own items of high value.

Today, we dive into what NFTs are, what are they used for, and how a game called CryptoKitties clogged the Ethereum blockchain in late 2017.

What is Non-Fungible Token (NFT)?

Non-fungible Token (NFT) is a type of cryptographic on the blockchain that represents a single asset. This could be a virtual asset or an encrypted version of an asset in the real world. Since NFTs are NOT interchangeable, they can act as proof of authenticity and ownership in the digital realm.

Therefore, NFT has 2 properties: UNIQUE and LIMITED.

The following example will help you better understand the NFT: A $10 bill you can be exchanged for another $10 bill from someone else, assuming that it is genuine. This is a fundamental property of assets that serve as a medium of exchange. In theory, there is no way of recognising their differences (other than the money series number). However, exchangeability is not a trait in favour of collectable items.

What if we could create digital assets similar to Bitcoin, but add a unique identifier to each asset unit?

This will make each of them different from all the others (i.e., irreplaceable). Basically, this is what NFT is.

How does NFT work?

First of all, we need to understand that NFT is essential items that can be collected. Like a painting, rather than a typical token which has lots of incentives associated with it to increase buyer demand.

Therefore, valuing NFT is like valuing a real-life precious item; whoever feels it has a price, will pay that price.

Example: There are a lot of abstract paintings that are worth a few thousand dollars. Very few people understand what they mean, for example, but people still buy them.

Speaking of issuance standards, usually on the Ethereum blockchain, tokens are popular in ERC-20. But in the NFT, a lot of standards are adopted, the most prominent of which is ERC-721. A recently improved standard is ERC-1155, which allows single contracts to contain fungible and non-fungible tokens, opening up a whole new range of possibilities.

Like other tokens, NFT can be stored in a personal wallet, typically a Trust Wallet. It should be noted that NFT cannot be copied or transformed without the owner's permission - even by the NFT publisher.

What is NFT used for?

NFT can be used by decentralised applications (DApps) to issue digital items and cryptocurrency collections. These tokens could be a collectable item, an investment product, or something else.

Or specifically in the field of gaming - plowing the top racing game and picking up good items is something we have all done at some point. There are many online games that have their own economy in games, so using NFT can solve or mitigate the common inflation problem many games face.

What about the real world?

NFT can represent small chunks of real-world assets that can be stored and traded as tokens on the blockchain. This can provide the necessary liquidity for many markets that would otherwise not have a lot of participants. Such as handicrafts, real estate, rare collectables, rare whisky, rare wines.

Digital identity is also an area where NFT's attributes can be beneficial. Storing identity and ownership data on the blockchain will increase data privacy and integrity for many people around the world.

Economic Value of NFT

NFTs Are Rooted In Human Psychology

Scarcity and attraction of investment

Valuation of scarce NFT tokens is a zero-sum game. A person will buy an NFT token because they see and believe that the NFT token has value. It may increase in value in the future because someone in the market will have a demand for it.

The net effect of an immeasurably large audience drives its own success, like an artist with a strong fan base producing a limited release artwork which is then desired by many people. Obviously, the valuation will increase proportionally with the growth rate of demand in the market and vice versa. NFTs must be tied to their psychological appeal to the user. Especially the desire for scarcity, which is a strong narrative.

Simple and Interesting

The process of collecting collections such as pictures, cards, virtual pets, items (costumes, weapons, accessories) etc. is a concept that is easy to understand and easy to implement for the user. It does not require any difficult research. At the same time it is an interesting stimulus for users to put in the effort to be special and collect the rarest of things.

Collectors do not necessarily see NFT buying as an accumulation of financial value (although they can be priced and traded), but as a game that satisfies their spirits. NFTs solve the problem of allowing the user to feel the positive psychological effect of visualising, buying and owning a special object (digital), reinforced by the the permissions, transparent data and immutable historical information (the metadata of the NFT).

NFT With DeFi

Let us look at an example:

We borrow from someone 1 $BTC or 1 oz of gold, then we can repay 1 $BTC or 1 oz of gold. If you borrow $100, you will repay $100. It is fine to repay with two $50 bills or an old $100 bill, that does not matter, as long as it is a total of $100.

However, with unique and rare assets such as Leonardo da Vinci's painting Mona Lisa, there is only one of it. In the NFT art world, the items are unique. It is not possible to replace the painting of Mona Lisa with a selfie of Lisa. Thus, when we have unique items in finance, we can start exploring the intersection between NFT and DeFi.

There are NFT projects that work on combining and exploiting DeFi features such as liquidity or staking to build the initial network. Project examples: Axie Infinity, Rarible and Meme.

Today features have been expanded further with NFTfi (Non-fungible loan platform) lending and borrowing, making it possible for users to borrow with a certain mortgage.

NFT x DeFi = NFTfi (Case Study)

NFTfi was launched in May 2020. NFTfi is a protocol that allows users to deposit/withdraw their NFT as collateral to borrow a corresponding $ETH.

Users can choose the desired terms for their loan (Example: interest rate and amount of $ETH) or expect better offers from other potential lenders.

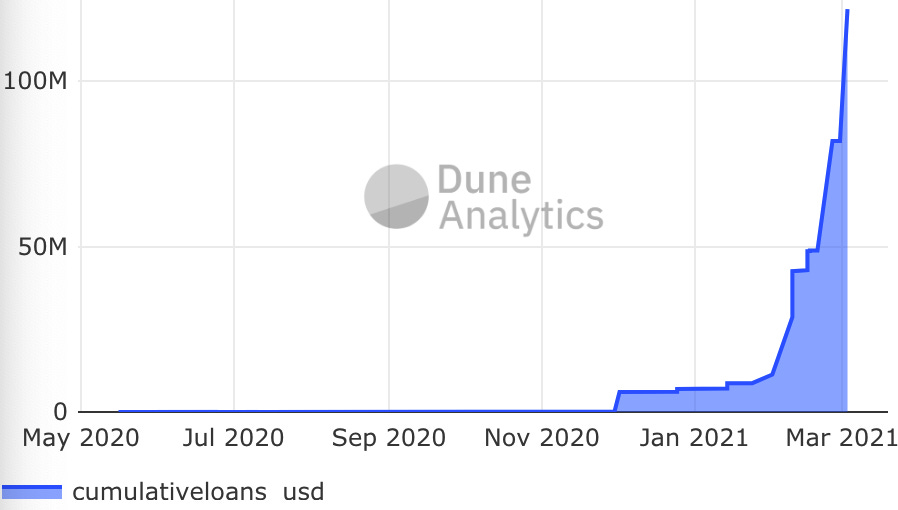

(The NFTfi platform has more than 120 users with more than $121M in loans from the NFT collateral source.)

Compared to DeFi pure application platforms, NFTfi is rated worse in terms of both applicability and capitalisation. But it cannot be denied its dominant role in the context of market size, level and time of development. NFTfi will help to improve liquidity for small-cap and low-liquidity assets, which is the basis for creating more breakthrough applications.

Initially, NFTfi will charge a 5% fee on the interest a lender receives upon completion of each order. As user demand increases and the number of loans increase, so will fees decrease. As can be seen in the graph below, this fee has brought the cumulative interest so far to more than $4.9M.

Resources: Dune Analytics query by Masonnystrom.

The future of integration between NFT and DeFi

Most people involved in the Crypto market have a purpose - speculation. From there it can be seen that DeFi-based NFT applications like mortgage loans will gain favour and grow faster.

For future growth, issues faced by users such as gas fees and wallet management need to be addressed. Besides lending, users will expect more in the development of NFTs based on inspiration from DeFi such as staking and insurance.

Not all NFTs are created equal but refine the foundations and protocols that deliver true value to make the right "money-down" decisions.

Listen on podcast if you prefer audio version.

TLDR:

In the past, NFT was valuable simply because people liked it, wanted to collect it, or found it interesting. These days, NFT has turned to DeFi to take the token to a new level. These innovations contribute to creating value for them. Despite the controversy surrounding the NFTs, they are still going strong.

Support us on Gitcoin donation to increase our video production and serve you better