Financial risk of DEX, using examples of UNI, CAKE, SUSHI

Analytical Report

One of the key areas of risk exposures we need to consider when analysing risk level faced by a protocol is the financial risk. Under our analytical framework, financial risk is a subcategory of unsystematic risk that can be predicted and controlled by the protocol under some extent. It is relevant to the construction of protocols, and the level of instability can be partially determined by the rules and governance within protocol.

How to define financial risk of a DEX?

We define financial risk as the risk of losing money in operating the protocol. This can be further grouped into three categories: cashflow risk, sources of potential instability and key ratios.

Cashflow risk

Risk from cashflow is one of the most direct and easily analyzed sources of financial risk. Similar to traditional projects and investments, protocols with healthier cashflow conditions are more likely to attract investor confidence and longer holding periods. The amount of cash held by a protocol significantly impacts its ability to stay through a market shock and other uncontrollable events.

Financial risk exposure from cashflow can be assessed using a protocol’s reported cashflow data. This includes detailed revenue, expenses and net income figures as reported by the protocol’s official documents and reported figures over time. Ideally, the breakdown of cash inflow and outflow tell information about how the project has been operating financially. This helps to identify which parts of cashflow are more stable and hence bringing less risk exposure, and which parts should more attention be paid to. The historical high and low cashflows can also be used to estimate the threshold and value at risk in extreme conditions.

Such cashflow data can be simply analysed by plotting out the cash inflow and outflow figures, and make comparisons on metrics such as monthly growth, yearly growth, second order growth rates, and ratio relative to the net cashflow.

Sources of potential instability

In addition to knowing how cash inflow and outflow have been changing across time, it is also important to understand how cashflow can be affected by factors relevant to the protocol, which we call the sources of potential instability.

Depending on how the project financially operates, including their source of revenue and expense, the sources of potential instability considered here may be different for all protocols. Some of the common factors affecting cash inflow are the fees to list a token pair onto the DEX, transactional fee for each successful transaction (again, the name could vary), and the gas fee paid by users when they commit relevant actions. For protocols offering yield reward to contributors of the liquidity pool, it is also important to track changes in the yield rate, which is a major factor affecting the amount of assets that stakers are willing to put in. While these events are highly influenced by the market and behavioural factors that are difficult to predict, understanding the average amount of cashflow in each time period can help us to understand a protocol’s risk position.

An important note when analysing the cashflow factors is that, the parameters and rates used in the defi sector are not constant. In most situations, these factors are prone to changes from governance voting, and may be changed if the majority of token stakers are unsatisfied with the existing set of rates. We need to consider if there is any predetermined policies on how these rates would change in the next few time periods, whether such voting and successful changes have already been made historically and how these have affected the cashflow, and also the possibility for such changes to occur in the foreseeable future.

This is also highly relevant to the governance risk, which analyses the degree of uncertainty from governance factors that affect the degree of participation in voting and the probability of having a proposal passed.

Key ratios

Instead of a standalone category, the key ratios can be seen as secondary descriptions of the cashflow figures and sources of instability. The key ratios will compare the important metrics of revenue, expenses and net income across categories, and the token price. By further analysing the MoM and YoY growth of these ratios, we can understand how protocol has been growing over time. Through identifying if the project is undergoing different stages of development, we can better assess the relative level of risk. For newer projects, it is reasonable to expect them to have higher instability. But for mature ones, high variations in key ratios that are not due to significant changes in operation could hint unhealthy cashflow and financial health.

The general key ratios to consider are the ratio of protocol revenue to market capitalization, token price to revenue, gas fees to revenue, and the relevant second-order growth. For risk analysis of decentralized exchanges, we can also consider trends in transactions and their impact on revenue, such as the percentage of revenue contributed by the top traded token pairs.

Key points to note for financial risk analysis

The most important point to note here is that the four categories of financial risk described above are not independent of each other. The key ratios are closely tied to cashflow performance, and the sources of instability may affect demand and supply factors of a token, thereby affecting the cashflow too.

The transaction trends of DEX are affected by many market and industry wide economic factors, hence they are highly volatile and may change significantly over different time periods. It is important to take note of the time frame we are analysing. A potential method here is to consider transactional data like the top traded token pairs, transactional volume and value, across various periods ranging from 24h, 7 days to 180 days. This allows us to compare for levels of financial risk across different periods, and also show changes within the protocol.

Cross comparison of UNI, SUSHI and CAKE

As an illustration of how the financial risk analysis framework works, we will present an example using a cross comparison of three popular DEX tokens: UNI, SUSHI and CAKE.

Cashflow risk

Due to the lack of information on the detailed breakdown of revenue and expenses (how much fees have been earned and paid out exactly, detailed purpose of cashflow) we will conduct a partial analysis using revenue.

Fig 1. Monthly revenue of projects

From the chart, we see UNI has the highest revenue earned for all months, followed by CAKE (except for its first month in April 2021) and SUSHI. This implies that UNI has the strongest cashflow and we can reasonably expect it to remain as the one with highest revenue out of the three projects.

Next, we plot out the growth rate of monthly revenue:

Fig 2. Monthly revenue of projects in % growth

The monthly growth rate in revenue is rather similar for the three projects as they serve the same purpose as decentralised exchange and are all exposed to market wide changes. Across the whole one-year period, CAKE has the most volatile growth and UNI has the smallest growth in percentage. This implies that the cashflow of UNI is the most stable, which is reasonable as UNI is the oldest out of the three projects, and is in a more developed stage. When facing macroeconomic changes in the whole token space, we can expect UNI to have the best ability in absorbing shocks and market-wide financial risk.

Sources of potential instability

Following our previous definition, the sources of potential instability refer to areas that may affect the future cashflows and ability of the project in cushioning to a market-wide shock. This differs for each protocol based on their mode of operation, revenue earning and expense spending.

For the distribution of revenue to token stakers and protocol treasury, there exists a risk that the existing rate could be changed through governance voting. If the protocol rate is voted to increase, it might impact future cashflow when liquidity providers choose to put their assets into projects that give higher reward.

For our comparison, while all projects stated that the fee schemes and distribution of revenue are subject to governance voting, there have not been historical changes, nor any significant signs that stakers are likely to initiate a relevant proposal soon. Thus from the area of factors of instability, the three protocols are on the same level of financial risk exposure.

Key ratios

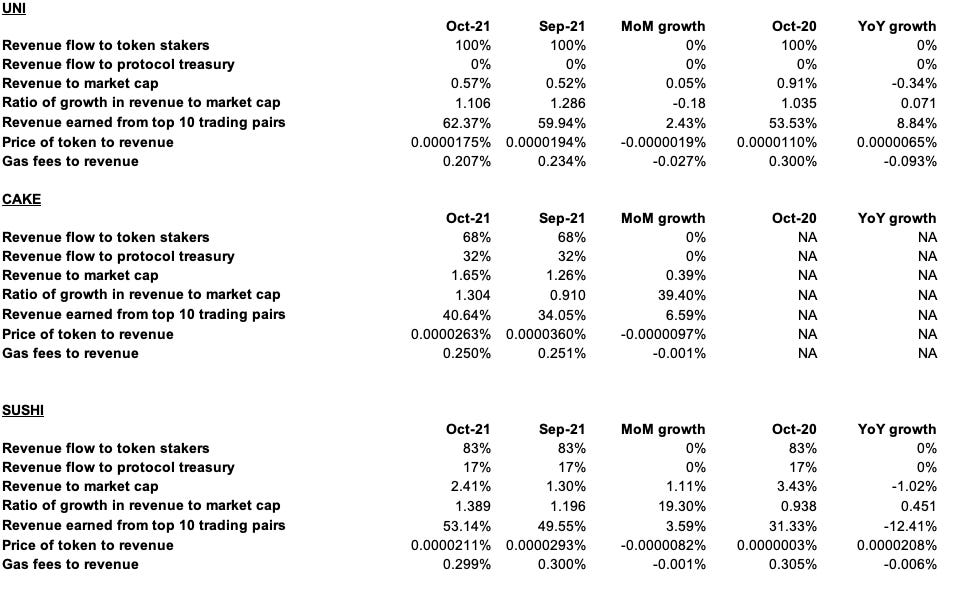

The key ratios give important information that helps our analysis of the financial strength of the project. We will look at the ratios for the current month, previous month and previous year to make comparison across time and across projects. By looking at how ratios have changed over time, we can also know if there are any structural changes in the project’s financial performance.

Fig 3. Key ratios of projects

From the above data, one of the most significant differences in the three projects are their distribution of revenue to token stakers and protocol treasury. An interesting observation here is that CAKE has maintained a constant 32% supply side revenue, SUSHI at 17%, and UNI at 0%. While these figures alone do not give much information on the level of financial risk exposures, a high percentage of revenue for token stakers could lead to more instability in revenue if the liquidity providers are being affected by market conditions, but can also attract more investors in staking the token, hence increasing general financial performance.

Fig 4. Distribution of revenue to token stakers and protocol treasury

The ratio of revenue growth to market capitalization growth gives an indication of how the project has been making financial gains. In the long term, projects with a matching growth in the two indicators can be seems as having more stable financial figures and less risk.

The percentage of revenue earned from top 10 trading pairs gives information on to what extent the exchange is dependent on a few large trading pairds for revenue. When the percentage of this metric is high, the financial performance of the protocol may be more susceptible to market variations and hence less stable. This is especially likely if trading activities of the popular pairs are highly correlated to each other. But we should always note that ranking and compositions of the top traded pairs could vary from time to time. In order to fully explore potential risk exposures from trading activities within the exchange, we should consider making an in-depth analysis across various time period, and see how changes in trading trends have affected revenue to the protocol.

Conclusion

Through the above comparison, we see that Uniswap is the project facing the highest level of financial risk exposures. Being a relatively more mature protocol out of the three projects been compared, Uniswap has the strongest financial performance and the most stable growth figures. These give the project better ability to cushion for a market wide shock and sustain through a crisis.

Sign up to our research site Econteric and get access to many more analytical and fundamental reports.