Ins and Outs of FTX/Alameda Debacle

Welcome, premium subscribers! Thank you for subscribing. What will be shared today and the days ahead are alpha from our Economics Design's researchers.

Please keep these mails secret and do not share them with any one because these alphas are confidential. Enjoy your reading.Brief Context

The behemoth FTX, one of the largest Centralized Exchanges in the world, with $9.5 billion of trading volume per day and roughly 10% of the global perpetuals market share was featured in every news headline in the past two weeks - and not for the best reasons. On November 2nd, Coindesk reported the potentially fragile financial situation of Alameda Research (FTX’s sister company) through accessing private information. In short, Alameda’s balance sheet had $14.6 billion in assets, but 40% of it in F 0.00%↑ token, issued by its related party company FTX. As a result, the crypto community started to raise concerns about the ongoing strength of Alameda's balance sheet. In this piece, I look at the timeline of events, while bringing light to unusual asset exchanges starting in October until mid-November, post FTX collapse.

Key Topics this Article will Cover:

Alameda Research Balance Sheet – First Alarm

Uptrend in withdrawals started before CZ’s tweet - Second Alarm

M&A attempt & Chapter 11 - Final Alarm

Key wallet addresses to keep track

Future outlook and next steps

Alameda Research Balance Sheet – First Alarm

$FTT is the native token issued by FTX, and is the main utility token used in the ecosystem. The key utility of $FTT was to acquire benefits such as fee discounts, early access to NFTs and token launches.

So what exactly was shown by Alameda’s balance sheet? The company reported $14.6 billion in total assets, with 40% of it in $FTT exposure - $3.6 billion in $FTT holdings plus $2.16 billion in $FTT collateral. The remaining 60% were composed of other crypto assets, cash, and equity investments. Liabilities, on the other hand, amounted around $8 billion, with $7.4 billion of that in outstanding loans.

Alameda Research's Assets - Breakdown (in %)

Source: Economics Design

By only looking at assets and liabilities, it seems that its financials were under control. However, when we analyze the origin and quality of the assets held, the story is a lot different. Starting with $FTT, it had around $3.3 billion in total market cap, but $8.8 billion in fully diluted market cap. In other words, there were over $5 billion in $FTT mints that were not yet released to the market (locked tokens) but held in Alameda’s balance sheet as collateral or outstanding assets. This picture tells us that almost half of Alameda’s assets were in reality created out of thin air by FTX, and later on transferred to Alameda through loans and private deals. Investment rounds in developing projects were financed by newly minted tokens and loans backed by $FTT as collateral, using FTX’s reputation as a backup for closing deals in such terms.

This was just the tip of the iceberg.

Uptrend in withdrawals started before CZ’s tweet - Second Alarm

With the news hitting the headlines, crypto investors started speculating about potential impacts of the situation, with some defending that the claims were overstated, while others believing it was a real issue. There was no consensus between industry analysts, until November 6th, when Binance CEO, Changpeng Zhao (”CZ”), tweeted the following: “As part of Binance’s exit from FTX equity last year, Binance received roughly $2.1 billion USD equivalent in cash ($BUSD and $FTT). Due to recent revelations that have come to light, we have decided to liquidate any remaining $FTT on our books.”

His statement set the crypto industry on fire, and the community went on to rethink their exposure to FTX and $FTT holdings. The immediate impact, however, was not as exacerbated as one would’ve thought and the $FTT price went from around $25 to $21 in a 12-hour timeframe, almost a 20% drop. Minutes later, Caroline Ellison, Alameda’s ex-CEO, replied to CZ stating that Alameda Research would “happily buy it all for $22”, suggesting a potential OTC deal with Binance to minimize $FTT price impact from large sales by Binance, which was publicly ignored. A potential reason for holding a specific $FTT price around $22 could be to avoid liquidation of Alameda/FTX/SBF loans collateralized with $FTT. Price resilience was supported by SBF’s tweet stating that “a competitor was trying to go after them with false rumors”. In hindsight, this controlled drop confirmed that investors were still not aware of the size of the problem, and temporarily decided to trust in SBF until formal communications were published.

FTX - Deposits and Withdrawals (in USD millions) - Sunday, November 6th

Source: Economics Design On-chain analysis

At the same time, due to this potential insolvency risk, investors were pulling out their funds from the exchange at record rates in terms of number of withdrawals - most likely retail investors due to average withdrawal size. On Sunday 6th Nov 2022, SBF stated that FTX had almost $5 billion in withdrawal requests, which was more than 24 times daily average withdrawal size. However, through on-chain analysis, we found a net outflow of only $245 million ($910 million in withdrawals minus $664 million in deposits). With at least $1 billion of clients' funds missing, and around $8 billion in uncovered liabilities, the exchange did not have enough cash to process all withdrawal requests.

Before we keep moving forward with the timeline of events, it is critical to observe a noticeable pattern suggested by on-chain data. Our team at Economics Design performed on-chain analysis and it became clear that the bulk of withdrawals happened after Coindesk’s article, but before CZ’s tweet.

FTX - Stablecoins Withdrawals - Count of Withdrawals

Source: Economics Design On-chain analysis

FTX - Stablecoins Withdrawals - Cumulated Flow (in USD)

Source: Economics Design On-chain analysis

We observe net negative flow of stablecoins ramping up around October 24th, a week before Coindesk’s report regarding Alameda’s balance sheet. According to Bloomberg, around that time SBF was in the Middle East, on a mission to raise additional capital and save the company from its immediate liquidity needs. Bloomberg also stated that Bankman-Fried had meetings with Saudi Arabia's sovereign wealth fund and Mubadala Investment Co, but had no luck in his endeavors. The news source also states that while SBF was away in his fundraising attempt, employees in other subsidiaries were also chasing funds to save themselves from the potential liquidity risks - Voyager, FTX US Derivatives, and even the naming rights for Miami Heat's arena, which was until recently called "FTX Arena” had been up for grabs.

There is no concrete information if there have been some insider actions, but data indicates that withdrawal acceleration started before CZ’s tweet.

M&A attempt & Chapter 11 - Final Alarm

On November 8th, FTX halted withdrawals and announced a signed Letter-of-Intent (LOI) by Binance, a formal document stating its competitor’s interest in fully-acquiring FTX International, along with initial negotiating terms. The deal fell through shortly afterwards, and markets responded quickly with an -80% drop in $FTT price in a matter of hours. As most of the company’s declared assets were in the exchange token, insolvency became an obvious reality.

On November 11th, Chapter 11 filing was announced and Bankman-Fried stepped down as CEO. FTX, Alameda Research and all its subsidiaries have started formal bankruptcy procedures since then.

Certain wallets were able to transfer funds out of FTX after withdrawals were suspended. Bahamian addresses? Preferential addresses? Family and friends?

While withdrawals were already disabled, funds were still flowing out of the exchange. Certain wallet addresses were able to move funds out of the exchange even after the halt happened. According to a FTX tweet on November 10th, users based in the Bahamas had facilitated withdrawals due to “regulator requests”, which was denied by local authorities two days later, on November 12th.

FTX - Stablecoins Withdrawals - Count of Withdrawals

Source: Economics Design On-chain analysis.

By analyzing just the top 10 addresses who withdrew funds from FTX after the halt, around $27 million was retrieved by such individuals. The flow of funds was being tracked in real time by the crypto community, which created a black market for local accounts so that others could also save their remaining funds. As this loophole came to light, investors started to exploit NFT purchases as a way to retrieve their funds. According to CNBC, some individuals were buying NFTs from Bahamian owners at surreal prices, enabling those funds to exit the FTX ecosystem, and later on transferred back to the original account owner. For instance, an NFT that traded for $9 just weeks prior was then sold for $10 million. In short, NFTs served as a financial instrument to access frozen funds from accounts around the world via the Bahamas - where it was still possible to perform withdrawals.

The largest outflow seen happened on November 12th, totalling over $400 million, and supposedly due to a hack. Majority of investors did not believe in this version and accused internal actors as responsible in an attempt to hide remaining assets. On November 17th, however, the SCB (Securities Commission of the Bahamas) published an official statement explaining that it was actually a government asset seizure in order to protect customers' assets.

If Bahamian authorities negated the rumored requests for allowing withdrawals, who were the individuals with privileged access?

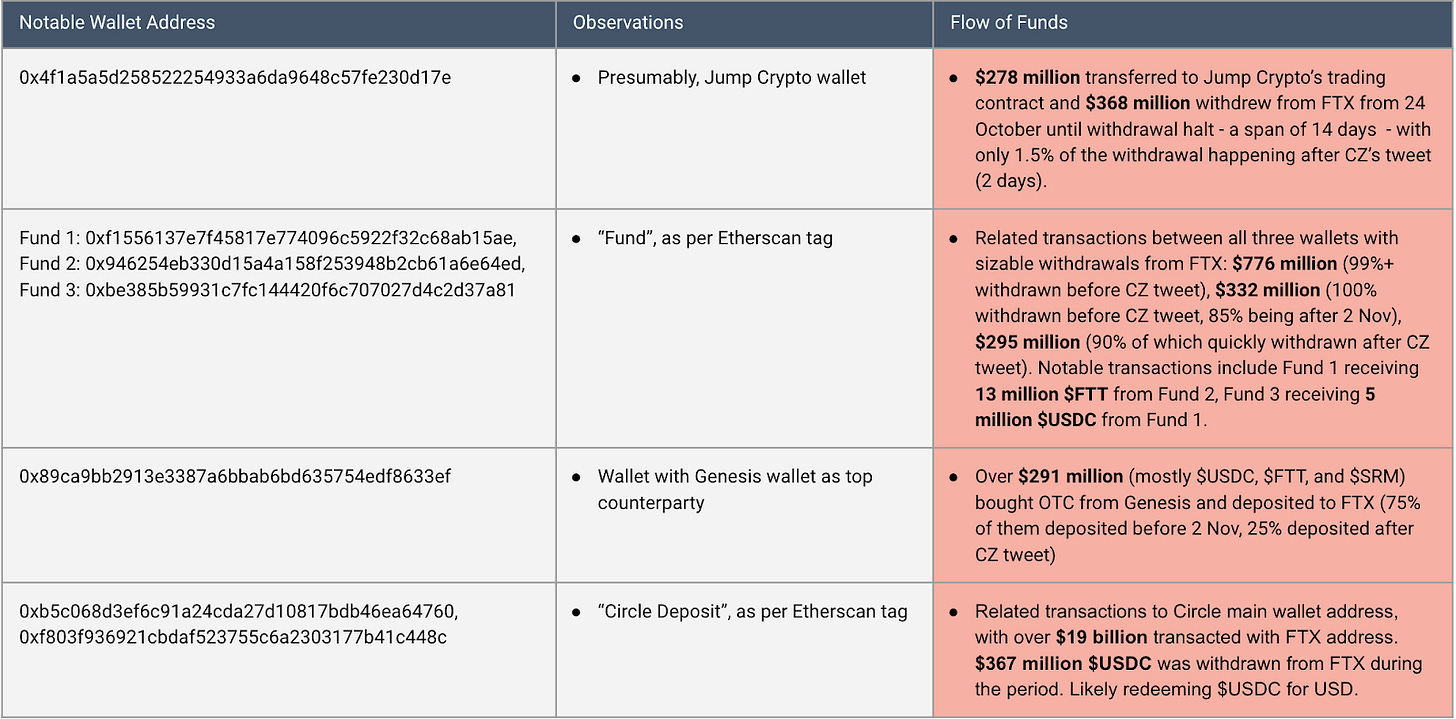

Key wallet addresses to keep track

By only analyzing on-chain data, while we can trace back each wallet’s origins, it is almost impossible to discover the holder's identity. However, we can still keep an eye on most relevant wallet addresses to watch flow of funds over time.

Below you may find some notable wallets with summary notes, and we would like to leave it open for the community to gather more info about them.

Pre-halt

Post-halt

Future outlook and next steps

The FTX collapse is definitely going to be marked as one of the worst financial disasters in crypto history. From this context, we can draw a parallel to cases such as Enron and Madoff, classic TradFi frauds supported by lack of corporate governance procedures and regulators oversight. As such, we must carefully investigate its root causes and create policies/guidelines to avoid similar outcomes in the future. But, every cloud has a silver lining. While this will negatively impact the crypto sector in the short-term, there are also positives to be drawn out of it.

Crypto will evolve and survive. Just like it did with Mt. Gox (CEX with 70% market share), Terra-Luna, 3AC, Celsius, and now… FTX.

Transparency & Regulation

Industry-wide crypto regulation will accelerate, focusing on more transparency

Additional controls will be put in place for compliance and customer protection. CEXs are already being pushed to perform Proof-of-Reserves and Proof-of-Liabilities, an initial step towards this direction

Trend will affect not only US laws, but worldwide

DeFi Credit Protocols Resilience

DeFi credit protocols showed great resilience during this Black Swan event, and there was no liquidity shortage

“Code is law” narrative, applicable to DeFi protocols purely ran by code, will gain strength for next cycles

Self-custody

Blockchain users need to adapt and to acquire the discipline of self-custody, relying less on third-parties and safeguarding their own assets

Risks of relying on third-party actors, such as a bank, will emerge as key discussion point moving forward

FTX collapse has one key origin: human misconduct. The root cause was not related to neither financial engineering, nor the underlying asset per se, but rather to fraudulent activities. FTX is the perfect example of a company with poor internal controls, weak compliance procedures, and inexistent boundaries between related companies. The perfect formula for disaster.

Got a question for our author regarding this article? Contact him at:

Giovanni Populo | Associate Consultant

E: Giovanni.P@economicsdesign.com | W: EconomicsDesign.com