Interest Rate Swaps in DeFi

What is Interest Rate Swaps ?

Welcome, premium subscribers! Thank you for subscribing.😘 TLDR below. This is not financial advice.

General Conclusion

Last week on the fixed interest rate, we covered Zero-Coupon Bond. The coupon is paid upfront or at maturity and divided equally per month.

Another method to get a fixed interest rate is via Interest Rate Swap. That is what we will focus in this article today.

What's Interest Rate Swap?

Swap is a financial derivative product consisting of 2 transacting parties making a series of payments to the other in a certain period.

As you can imagine, it is to swap the interest rate. We exchange the interest rates.

E.g. I have an asset that has a changing interest rate. It pays me 3%, 2%, 3.5%, 0.17%, 4.2%. Instead, I want it to give me a consistent 2% instead.

How do we do this? Via interest rate swaps.

Why do we want this? Because we prefer something stable and consistent. It helps with financial management.

Types of Swaps

There are 4 kinds of swaps based on underlying asset properties: Currency swap, Interest rate swap, Equity swap and commodity swap.

The interest rate swap has 2 transacting parties performing a series of interest payments to the other. Both payments are in the same currency. One party pays floating interest, the other can pay at a floating or fixed rate.

Note: you only swap the interest rate. Not the asset itself.

In this analysis, we focus on the interest rate swap, which has one side paid by paying the float interest rate. The other side is paid by the fixed interest rate. This also is called a Plain Vanilla Swap.

Swap Details

Swaps have a

begin date

end date

interest payment period

As a future contract, swaps do not have any party prepayment. So swaps have an initial value = 0. That means present value (PV) is the same. The date which payment occurs called settlement date and the time interval between two payments is called a payment cycle.

Payments will usually occur for a short period of time, usually 1 day. This is because floating rates often change continuously, so payments will have to be made within the specified time.

Each Swap is materialised by a transaction amount called estimated capital. Because Interest Rate Swaps include the payment of interest, the settlement of which is calculated by multiplying the period of the interest by the initial capital which is never paid out. Therefore, it is not called the initial capital but rather the estimated capital.

Valuation

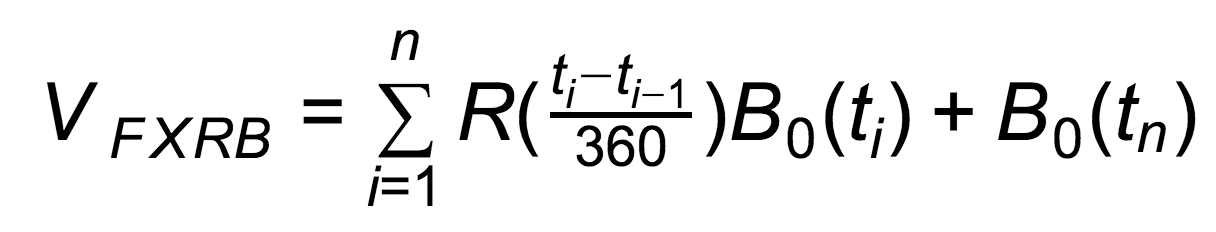

The above formula is the present value of the interest and original capital of a fixed-rate bond. All interest rate is determined at 0 time (at the time you buy swap).

The present value of a floating-rate bond.

And Swap's value is:

Direct Collateralised Swap

In DeFi, they call Interest Rate Swap is Direct Collateralised Swap. User want fixed interest rates to control risk and resources. These users will pass the interest rate volatility risk to others who readily accept it.

In DeFI, the contract's settlement period is converted to payment at maturity. Therefore, the above formula will be changed a little and simpler, but in general, still have the same concept.

Those who find that adopting a floating rate will benefit if the spread between the floating and fixed rates is negative. And vice versa.

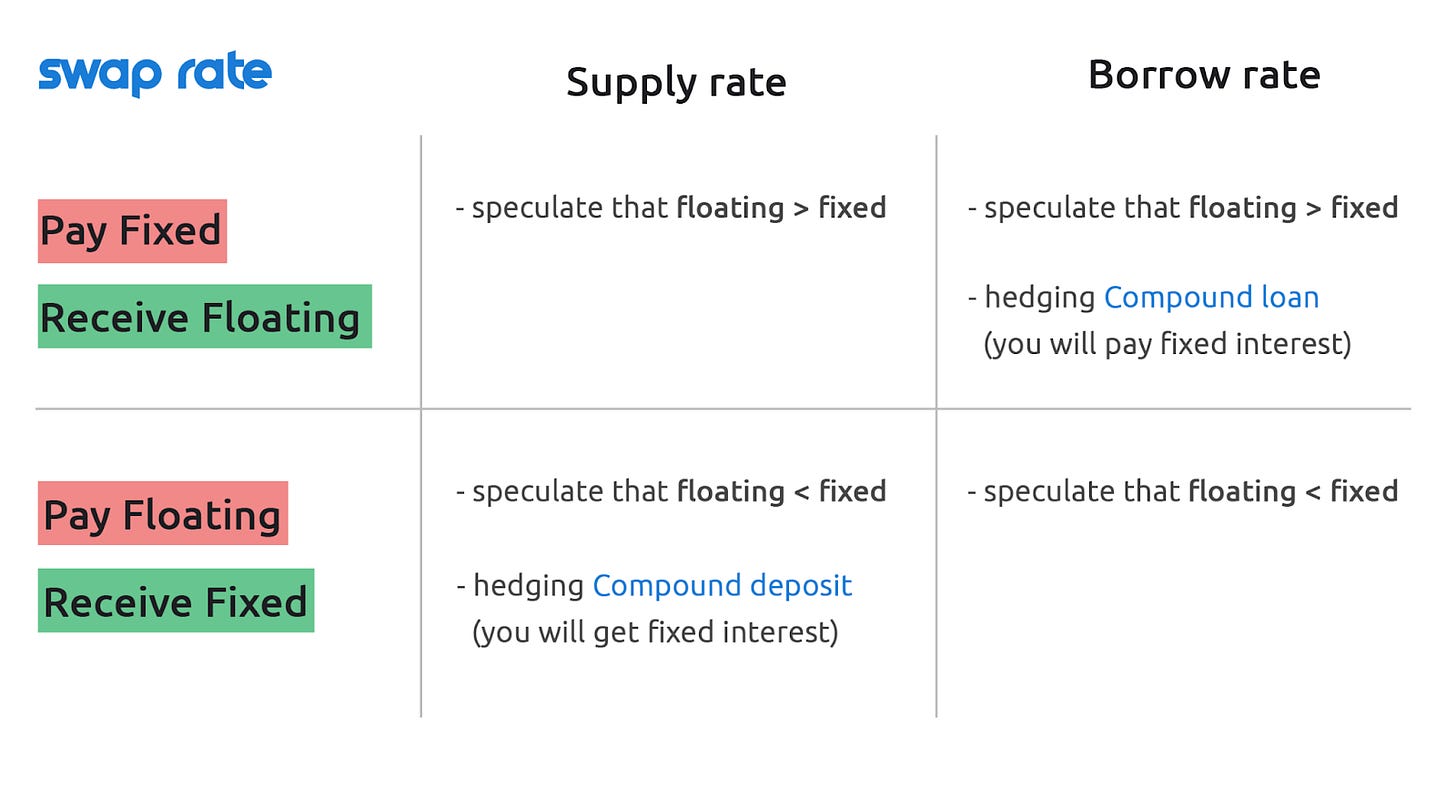

People who use an interest rate swap often to speculate or hedge future loan/loan interest rates and are traded by:

Portfolio management.

Corporate Finance.

Risk management.

Speculator.

Back, Direct Collateralised Swap in DeFi currently has 2 projects approaching in this direction: Swaprate.Finance and Swivel.Finance.

SwapRate.Finance

Swaprate is a platform that allows users to convert from Pay Fixed to receive floating and vice versa. It is used to hedge or speculate interest rate fluctuations in DeFi such as Compound, Aave.

For example:

Suppose Bob thinks that in the next 3 months, DAI's lending rate on Compound will drop to 0%. Bob uses Swaprate to set an order to receive APY 7% fixed rate and pay a floating rate.

Alice thinks the opposite, in the next 3 months interest rates will increase to 10%. Therefore, she uses Swaprate to set a 7% APY fixed rate pay order and receive a floating rate.

Two people set orders and match each other with the same level of collateral. Three months after the interest rate returns to 0%, Alice has to pay Bod an APY 7% interest rate and she receives a 0% interest.

Swivel.Finance

Swivel Finance allows lenders with fixed interest rates to match borrowers with floating rates through Aave or Compound liquidity.

How it works?

Similar to Swaprate, Swivel Finance will allow users to match orders, but then, the total funds matched will be transferred to a smart contract. The smart contract will move into Aave or Compound to lend, receive aTokens/cTokens and lock in the smart contract at the agreed time.

For example:

Alice has $1,000 to lend at a fixed rate of 5% APY, Bob realizes that the next 12 months the floating rate on Aave will be more than 10%, Bob goes to Swivel Exchange and sees Alice setting a $1,000 order at 5% fixed rate and buy it.

At this point, Bob only needs $50 to execute because the fixed rate is 5%. Eventually, Alice receives $1,050, and Bob needs to provide that additional $50.

After $1050 is transferred to the swivel contract, it will be transferred to Aave loan with a floating interest rate, when you lend, the aTokens will be received and locked in the contract.

One year later, the contract matures, the interest is now 12%, Bob interest is 152%, equivalent to $126. Alice received $1,050 as the original agreement.

Conclusion

There are also many other projects with other fixed interest rate applications such as Horizon, Cherry Swap, 88mph, Barnbridge.

Talking about Interest Rate Swap products, it is mainly used by professional financial institutions, financial corporations, investment funds. Therefore, it is necessary to have a large amount of liquidity to meet demand.

It is growing rapidly by adopting products available from traditional finance. The traditional financial concepts are applying in new ways in Defi. That being said, with new innovation comes new risks. Especially technological risks like smart contract risks.

TLDR: When it comes to fixed interest rates, it is the interest rate swap and the variable interest rate. Because of this, you can see that projects will often do the fixed interest rate and interest rate swap/market.

Get smart: DeFi's current situation is yet to meet that demand, but this could be the starting point for DeFi's fixed-rate and swap-rate segment.

Ps: Order the textbook "Economics and Math of Token Engineering and DeFi" today!