MakerDAO case study

MakerDAO.

Welcome, premium subscribers! Thank you for subscribing. I appreciate you very much. TLDR below. This is not financial advice.

General Conclusion

MakerDAO is a DAO based platform that contains $MKR and $DAI. $MKR and $DAI are two types of tokens in the ecosystem, where $MKR is the governance token and $DAI is the currency token. $MKR (and its holders) govern $DAI and its stability.

$DAI is soft pegged to the USD. 1 $DAI is about 1 $USD. This value is maintained by the collaterals and $MKR token holders.

A DAO is a decentralised autonomous organisation where no central entity owns the ecosystem, nor governs it. It is governed in a decentralised way, both with the machine (automation) and humans (non-automation).

We had a Introducing MakerDAO and here and FAQ

MakerDAO beyond Stable Coin Protocol

MakerDao is an alternative source of leverage; it is an alternative way to gain access to leverage for those who do not wish to custody assets with a centralised exchange. Borrowing from Maker could also be cheaper when stability fees are low.

Besides, any losses incurred by $DAI holders are backstopped implicitly by $MKR holders, who will be diluted in case the system as a whole becomes under-collateralised. This is a major advantage that Maker has versus other lending platforms on the market, where any losses are borne by the lender.

However, MakerDao has some disadvantages. The governance process can take some time before changes can happen. The Stability Fee and The DSR occur through voting instead of being algorithmically determined like in Compound. $DAI can trade away from the peg for sustained periods if governance does not react quickly enough.

There are risks in collateral prices falling too quickly for the system to liquidate in time. In these cases, the system can become under-collateralised, leading to losses for $MKR or $DAI holders (depending on whether $MKR holders are willing to assume losses). During periods when the price of collateral is falling rapidly, vault creators tend to rush to buy $DAI to close out their vault positions, leading to high $DAI prices relative to the peg. This also leads to a relatively weak peg, as I mentioned.

How Maker Works

To understand the mechanism design behind MakerDAO, let’s first understand how the system works.

The smart contract uses crypto assets (e.g. $ETH) through collateralised debt positions (CDP), to create $DAI tokens. These $DAI tokens are thus backed by these on-chain collaterals ($ETH, $BAT). In MakerDAO, the ecosystem is always over-collateralised, so the value of the collateral is always greater than the debt.

What is a CDP? A digital asset that is added into the MakerDAO ecosystem. It holds collateral assets deposited by the user and permits the user to generate $DAI. Generating $DAI accrues debt. This debt can be paid anytime or when the owner wants to withdraw their collateral (CDP).

MakerDAO, the system, enables anyone to leverage digital assets (e.g. $ETH) to generate $DAI, the output. Then, like any other currencies, $DAI can be freely spent.

Another way to look at it is that new $DAI tokens are minted when a user stakes their digital assets ($ETH, $LINK, $USDC, $YFI) with MakerDAO’s smart contract. By staking digital assets, they can create $DAI.

Tokens in Maker

MakerDAO uses a 2-token model in its ecosystem. This is because each token has a specific objective and function.

$DAI is the token with a money function, and it acts as a form of currency. It is a form of payment (via DeFi), store of value (1 $DAI = 1 USD) and unit of account (1 $DAI = 1 USD).

$DAI is also known as a “stable coin” because it is soft pegged to 1 USD. The value is backed by collaterals on-chain via CDP. It is completely decentralised; anyone who wants to own $DAI can buy it on the exchange or stake $ETH for $DAI.

$MKR is a token with a utility function, and it acts as a form of governance in the MakerDAO ecosystem. $MKR holders are part of the decentralised governance for $DAI. They are responsible for the decision-making process. They can vote and have a say on issues and proposals in the ecosystem. $MKR tokens are created or destroyed in accordance with price fluctuations of the $DAI coin in order to keep it as close to $1 USD as possible. $MKR has a value, and the value is determined by market forces, e.g. demand and supply of $MKR tokens.

[Token Design] Financial Incentives

Token Financial Incentives

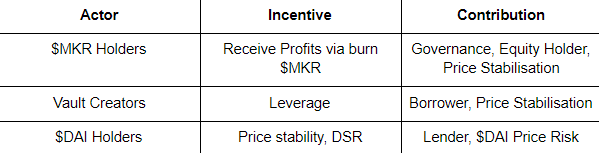

There are 3 main groups who play a major part in the MakerDao Ecosystem

$MKR holders

$MKR holders are akin to the shareholders in MakerDao protocol and have two main functions.

$MKR holders partake in profit and losses of the protocol:

When there are under-collateralised loans, $MKR is minted and sold to re-collateralise the entire system which dilutes $MKR holders and leads to losses. This makes sure that $DAI is always backed by a sufficient amount of collateral.

In return for this risk, The Maker Buffer contains $DAI proceeds from the Collateral Auction (including liquidation penalties), as well as the Stability Fees accrued from Vaults. When the amount of $DAI in the Maker Buffer reaches a specific number (determined by Maker Governance) the surplus amount is put into a Surplus Auction and is used to buy and remove $MKR from the total supply. So the price of $MKR increases and brings benefits to $MKR holders.

Vault Creators

Vault creators deposit collateral crypto to borrow newly minted $DAI. There are many ways to use $DAI, but in general, they want more leverage.

Upon receiving the $DAI, the vault creator will typically buy more collateral and place it in their vault to increase their Collateralisation Rate. By repeating this many times, they gain more leverage through increasing collateral and at the same time they are exposed to more Liquidation Ratio risk when the collateral decreases in the price market.

Each time the process repeats, the collateralisation ratio decreases, and leverage ratio increases. The maximum leverage obtainable with a 150% minimum collateralisation ratio is 3x. The chart below shows this effect.

It should be noted that as users use more leverage, the risk of liquidation also increases. With a minimum collateralisation rate of 150% at 3x leverage, the vault creator is responsible for liquidating as soon as the collateral falls in the price market. This is why borrowing the maximum amount might not be wise.

Arbitrage

When the price of $DAI falls below $1, vault creators are incentivised to buy $DAI and repay their debts, thus reducing $DAI supply and putting upward pressure on prices.

Similarly, when $DAI is trading at a premium, it becomes more attractive for vault creators to pledge additional collateral and mint more supply.

$DAI Holders

$DAI holders buy $DAI from vault creators - lenders in the system. Like lenders buying bonds, they bear the risk of default, although any loss due to the mortgage will be handled by the $MKR holder first.

To compensate for the loan, holders of $DAI receive DSR. Similar to how stable fees affect vault creators' willingness to borrow, DSR affects Dai holders' tendency to hold $DAI.

$DAI holders have limited risk - if the system's losses are so great that $MKR holders are unable to absorb them (i.e. $MKR's price goes to 0), then the $DAI's value will also decline as the system will then be under-collateralised.

The $DAI Savings Rate

DSR allows any $DAI holder to earn savings automatically and natively by locking their $DAI into the DSR contract in the Maker Protocol.

Currently, the DSR is set to 0%.

Token Distribution

Total supply of $MKR is 1,000,000.

Currently only teams still hold a large amount of 93.56% $MKR tokens (93,556.19 $MKR) and are controlled by Multisig.

MakerDAO Today

MakerDAO is still implementing its function properly. The key to this project is to create a stable copper. However, $DAI is not really anchored to $1 over time. What makes it so?

Below is a chart showing $DAI and $USDT hourly exchange rates in Q4 2020 Although both have maintained their pegs to a degree, $DAI is generally more volatile than $USDT with greater deviations from the peg. This is $DAI’s weaker peg.

Unlike many fiat-backed stablecoins, users cannot redeem $DAI for their fair share of collateral, except when Emergency Shutdown is activated. This removes one of the strongest price stabilisation policies available to maintain the peg and instead replaces it with the expectation of future redeemability, which is much weaker.

Stability fee and DSR adjustments by $MKR holders could be a powerful long-term stabiliser, but it can be difficult to achieve optimal levels of monetary expansion and contraction using interest rates. Currently, DSR is 0 which makes these policies weaker. However, if done correctly, this will likely be the primary means for $MKR holders to hold the price of $DAI steady - a tough balancing act compared to the simple mechanism used by fiat-backed stablecoins!

Furthermore, Vault creator and Keeper arbitrage of the $DAI price only functions over the short term, since any buying or selling done by arbitrageurs will reverse once the price reaches the intended level (i.e. they will have to take profit by unwinding their trades).

This is a relatively weak peg!

TLDR:

In conclusion, MakerDAO is a novel and innovative protocol that allows for on-chain collateralised borrowing, while also creating a reasonably effective stablecoin. This gives the crypto community an alternative to fiat-backed stablecoins like $USDT. Furthermore, $MKR holders are continually making improvements to the protocol, so it is very likely that the risks we have outlined could largely be mitigated in the future.

Support us on Gitcoin donation to increase our video production and serve you better

Ps: Order the textbook "Economics and Math of Token Engineering and DeFi" today!