Perpetual Futures Mechanism (2/2)

Funding Rate.

Welcome, premium subscribers! Thank you for subscribing.😘

TLDR below. This is not financial advice.

Summary

Last week we discussed the concept of Perpetual Futures and how they work. We also discussed the importance of Price Index and Mark Price. In this article, we will go into greater depth about the structure of how Perpetual Contracts operate and how they align behavior between Long and Short positions. We will also discuss putting Perpetual on-chain and if there are weaknesses when off-chain and are there solutions to fix them?

If you haven't read part 1, I recommend that you read it before continuing with this article. Let us start with Funding Rate.

Funding Rate

To ensure a long-term convergence between a perpetual contract and a reference price, Cexes use the Funding Rate.

Purpose Used primarily to bind convergence between futures prices and index prices.

Why is the Funding Rate Important? In futures contracts, there is a gap between the futures price and the spot price - known as Basis - depending on the contract specifications. At maturity, the futures price converges with the spot price and closes all positions. Perpetual contracts are widely offered by cryptocurrency exchanges and are designed similarly to futures contracts.

Unlike futures contract traders, perpetual contract traders can hold positions without having to expire. For example, a trader can hold a Short position permanently unless he or she is liquidated. Hence, perpetual contract trading is very similar to spot market trading pairs.

In short, cryptocurrency trading has created a mechanism to ensure that the Contract Price corresponds to the Mark Price. This is called the Funding Rate.

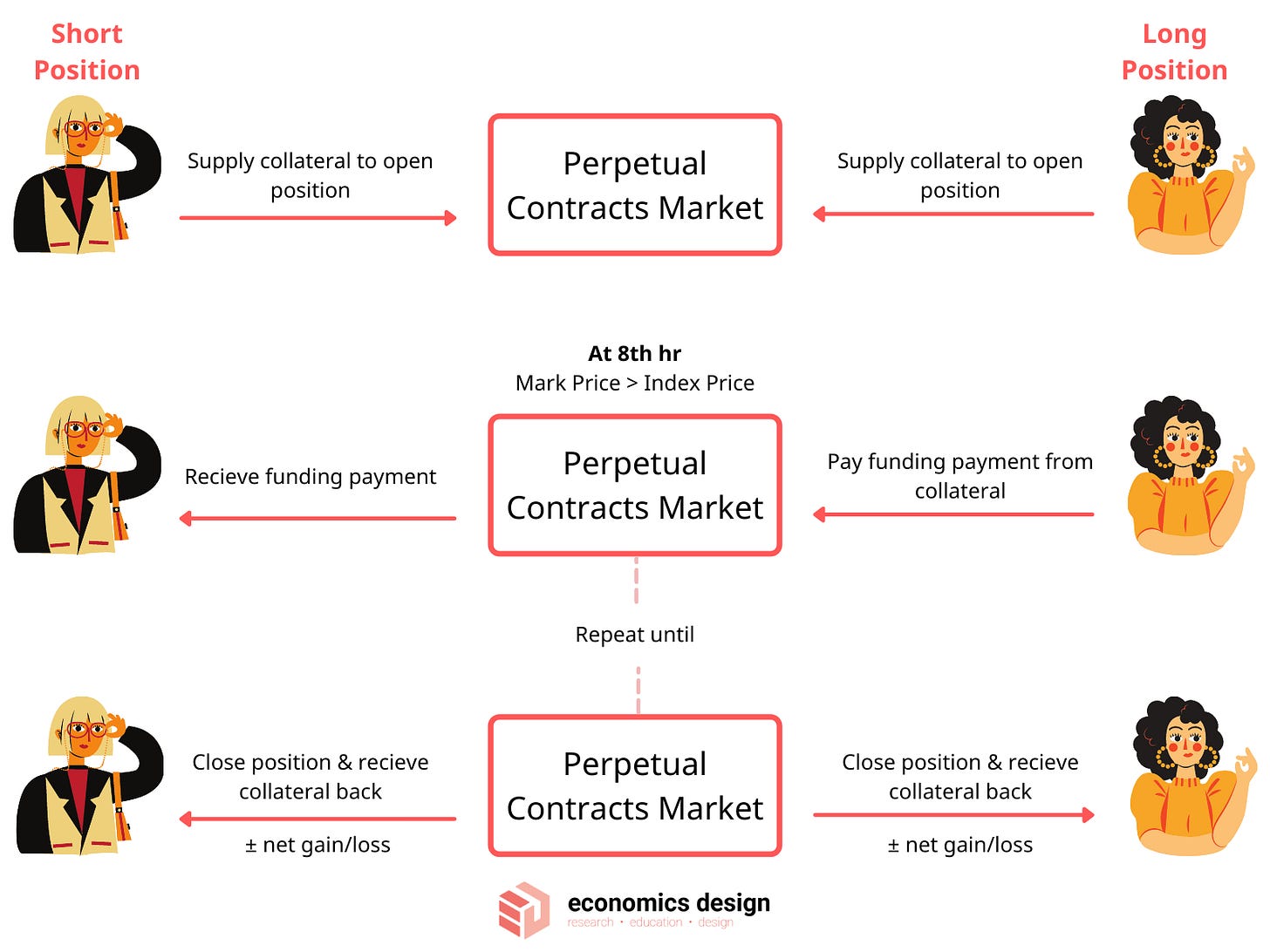

What is the Funding Rate? The Funding Rate between all Long and Short positions in the perpetual contracts market. The Funding Ratio determines which side is the payer and payee. If the rate is positive (Mark Price > Index Price), the Long position pays the Short position. This effect incentivises Long traders to open their positions, or Short traders to close existing positions.

And vice versa if the rate is negative (Mark Price < Index Price). Thus, the Funding Rate pushes the Mark Price to be closer to the Index Price.

CEX PerpFutures

On Cexes, the Funding Rate occurs every 8 hours. The trader is only responsible for payment (pay out or receive) if they have an open position past the above timelines. If the user does not take a position or closes the position before the above timelines, they will not be responsible for paying or receiving this fee.

How is the Funding amount calculated?

Funding Amount = Notional Value Of The Position * Funding Rate

Nominal Value Of The Position = Mark Price * Contract Size

DEX PerpFutures

Basically, decentralised perp Contracts have similar mechanisms to centralised perp Contracts. The Funding Rate is an incentive between Long and Short positions.

One project attempting to bring similar mechanisms to decentralisation is dYdX. They have an Order Book, Limit/Market orders, Stop Limit and Trailing Stop. This is good.

But this can only be done when combining centralised and decentralised data. For instance, if Order Book is decentralised it is a costly exercise. That is why many projects build Order Book off-chain with trading on-chain.

The question arises, is it accurate and transparent?

Remember, the Funding Rate is a two-edged sword. This mechanism encourages traders not to put too much position into one position and it balances them out. At the same time, the one-side position has to pay a Funding Amount to the other position, which adds risks for traders.

Who Is Solving These Problems?

AlphaX product, from Alpha Finance, is a decentralised non-orderbook perp contract product.

For AlphaX, Mark Price is adjusted automatically to take into account Funding Rate payments.

Specifically, Mark Price will be re-adjusted when it deviates from the Index Price by more than a certain threshold. When this happens, the price adjustment will be updated to converge with the Index Price.

Therefore, Funding Rate is not eliminated. Profits are made depending on when traders close their positions - either before of after Mark Price is adjusted.

For example, if Mark Price > Index Price (typically Long would pay Short traders), then Mark Price would be adjusted lower. If Short traders were to close a position after the Mark Price adjustment, they would be able to close at a slightly lower price than if they were to close before. And earn a profit higher than before.

But if Long traders were to close a position, they would close before the Mark Price adjustment. Because their gains will be higher than after.

What Happens When There Is Extreme Imbalance Of Long And Short Positions?

Short answer - Arbitrageurs will solve this problem.

In this case, the protocol still re-adjusts Mark Price so encouraging it to keep track of Index Price. This automatic adjustment also creates a huge arbitrage trading opportunity for any arbitrageurs who can rebalance that spread by opening Long or Short positions at a much better price. When spot prices are adjusted, arbitrageurs can make more profits.

TLDR:

Finally, we see that Perp Futures are essentially a variation of Futures Contracts and are successful in Crypto Space, as proved through Cex like Bitmex, Binance, Huobi, etc. They all provide these services.

From a decentralisation point of view, we are still developing to bring Perp Futures on-chain completely. There are many ways to do this like combining off and on-chain data or by designing another Perp Futures type like AlphaX.

In the future, we hope to see many better solutions, bringing more benefits to users.

Support us on Gitcoin donation to increase our video production and serve you better