Stablecoin Market Trends and Report

Welcome to all our subscribers. What will be shared today and the days ahead are free alpha from our Economics Design's researchers.

The following is a report from our research and analysis site Econteric which describes the trend of stablecoin markets as at July 2021.

Stablecoin Total Market Capitalisation

source: coingecko.com

In terms of overall market capitalisation for stablecoins, we have seen high demand and tremendous growth in the space due to the importance of the role played by stablecoins in DeFi. In Q2 2021, $BUSD experienced the largest growth in its market cap. This is likely due to the influx of users to the Binance Smart Chain due to high gas fees and network congestion on the Ethereum platform in Q1 2021. We take a closer look at the top 5 stablecoins by their market capitalisation.

source: coingecko.com

The top 5 stablecoin by market cap are $USDT, $USDC, $BUSD, $DAI and $UST respectively. The first 3 stablecoins are generally similar in that they are a form of fiat-collateralised stablecoin and have a centralised backing. The latter 2 stablecoins are a form of crypto-collateralised pegged stablecoin and are also considered to be decentralised.

Tether ($USDT) remains the most adopted stablecoin in circulation. For the case of $USDT, Tether Limited claims to back $1 worth of Tether for every $1 of USD, although there have been some controversies regarding this claim. As of July 2021, Tether executives are under federal investigation. The market cap for $USDT started to flatten in Jun 2021, but nevertheless recorded growth of 54% in Q2 2021.

USD Coin or $USDC is the 2nd largest stablecoin by market capitalisation. $USDC is governed by Centre, a membership-based consortium that sets technical, policy and financial standards for stablecoins. $USDC is issued by regulated financial institutions, backed by fully reserved assets and is redeemable on a 1:1 basis for US dollars according to Centre. In contrast with the decline in Tether's growth, we see a corresponding increase in $USDC's market capitalisation. $USDC market cap increased by a whopping 133% in Q2 2021, in comparison to Tether's 54%.

Binance USD (BUSD) is the 3rd largest stablecoin by market capitalisation and is similarly a 1:1 USD-backed stablecoin issued by Binance (in partnership with Paxos), and is approved and regulated by the New York State Department of Financial Services (NYDFS). $BUSD is used in the Binance Smart Chain and has also seen an uptrend in its market cap.

$DAI uses an over-collateralised mechanism to maintain a $1 peg of $DAI to USD. Unlike the 3 aforementioned stablecoins, $DAI is a form of crypto-collateralised pegged stablecoin and is decentralised. However, much of what collateralises $DAI involves $USDC. Critics argue this means that $DAI is backed by a centralised entity, making it susceptible to centralisation risks like the 3 stablecoins described above.

$UST is the stablecoin used within the Terra ecosystem. The $LUNA token in Terra is used to support the $UST stablecoin peg. The market cap of $UST is relatively small compared to the top stablecoins because $UST is not widely used in other blockchains but only has utility within the Terra ecosystems in protocols such as Mirror and Anchor.

Source: coingecko.com

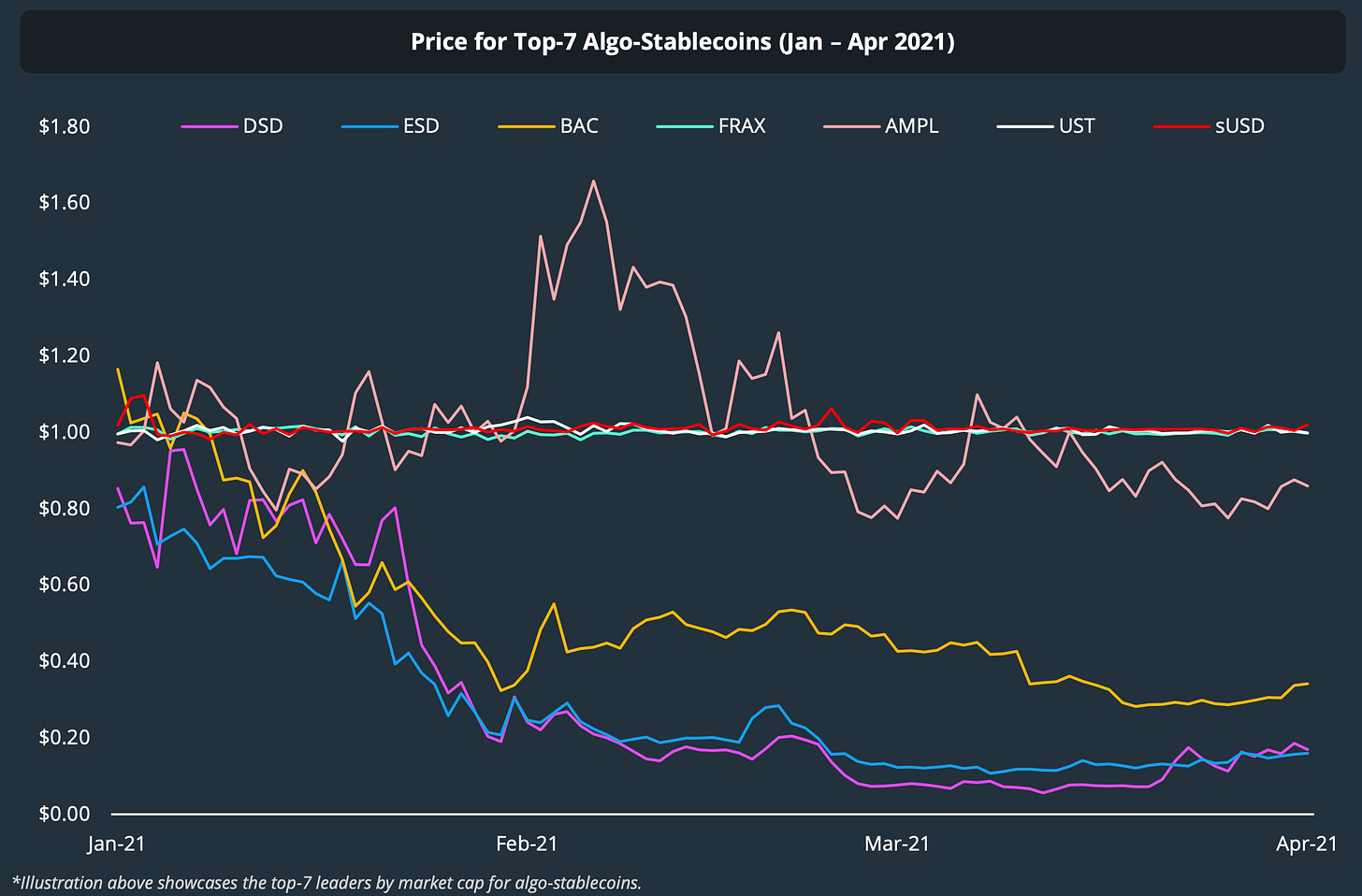

Algorithmic stablecoins are starting to develop this year but overall there are not too many outstanding projects. Stablecoins under the Rebase/Seignorage type models has not really performed in terms of maintaining their peg. Most of them have been priced below the peg price for a long time despite measures of price equalisation such as $ESD, $DSD and $BAC.

$FRAX, $UST and $sUSD are stablecoins with pretty good performance when it comes to keeping relative stability against the 1 US dollar. However, $AMPL, although dynamic around $1, has a very large fluctuation.

Source: coingecko.com

Stablecoin Supply Ratio

Cryptoquant recorded an ATL for the Stablecoin Supply Ratio (SSR), which measures $BTC market capitalisation relative to the total stablecoin supply to estimate purchasing power in the stablecoin market. Accordingly, when the price of $BTC falls, the amount of stablecoin purchases will increase to push the price of $BTC up and vice versa. But the growth of stablecoin supply in the spring of 2020 and 2021 has kept SSR near historic lows. This shows that demand for $USDT seems to keep pace with the demand for $BTC

Source: cryptoquant.com

Popular Stablecoins

Stablecoins were born with the noble function of resisting the strong volatility of other cryptos. However, not all efforts have been fruitful.

Stablecoins are now being used to exchange and pay more frequently than $BTC and $ETH . Velocity measures the rate of average trading volume against the market capitalisation.

A high velocity means that the cryptocurrency is widely traded within the economy.

Source: coingecko.com

$USDT and $BUSD have the highest speed, ranging from 1.0 to 3.0. Given the dominance of Binance as the top exchange and the rise of its blockchain (BSC), it is no surprise that $BUSD is being most widely used after $USDT.

According to statistics, Ethereum is still the top blockchain, accounting for more than 70% of stablecoins in the market as of January 2021. Tron, Omni, and Terra are next — proving that the stablecoin market is very active and the algo-stablecoin space is growing beyond just $UST.

Read more such Fundamental, Analytic and Market reports only on Econteric.com

Get premium access to unlock more content