STABLECOINS: BEYOND MEAN OF PAYMENT - SPERAX CASE

Welcome, premium subscribers! Thank you for subscribing. What will be shared today and the days ahead are alpha from our Economics Design's researchers.

Please keep these mails secret and do not share them with any one because these alphas are confidential. Enjoy your reading.Introduction

$1 bill in your pocket does not generate any yield...

Recently I have listened to CBER Webinar, where Gordon Liao from Circle talked about Stablecoins. One of the questions raised has been "Why stablecoins do not share with holders yield earned on collateral placements?". Reasonable answer that stablecoins primary use case is facilitating payments and store of value (not accrual of value). Indeed $1 stable coin is just a digital representation of a $1 physical bill and in real life holding a $1 bill in your pocket does not generate yield.

Key Topics this Article will Cover:

Sperax - promise of auto-yield generating stablecoin.

High level value flow

Aren't yield and peg stability add more risk?

Conclusion

Sperax - promise of auto-yield generating stablecoin.

What if stablecoins have been sharing the yields they are making on the collateral placements? Sperax with its USDs stable coin is one of those, that turn stablecoin use case natively from means of payment to saving account with auto-yield.

Sperax uses dual-token model:

USDs is a native stable-coin;

SPA is native governance and value accrual token.

veSPA is a voting power representation token (non-tradable/ non-transferable) that is earned through SPA staking. The longer the staking the higher the veSPA amount received.

High level value flow

Mint: to mint USDs you need to place eligible crypto collateral at lower of spot rate of collateral or $1 making it at least fully collateralized stablecoin. No fees are charged on mint.

Redeem: at redemption is charged a fixed fee 0.2%.

Use of collateral: Sperax places collateral to DEX Liquidity Pools and Lending Protocol pools, to generate yield. Based on Sperax analytics now 58% of assets are in the reserve (vault) and the rest is placed in Liquidity Pools to generate yield (Curve and Aave pools).

Important: If there is no immediate collateral value to satisfy redemption, the redeemer is still guaranteed to get its $ equivalent of USDs but in SPA tokens.

Value sharing:

● USDs holders get 50% of yield earned on collateral.

● SPA holders have multiple value accrual streams:

○ Burn: 25% of yield earned on USDs collateral is used to buy back and burn SPA.

○ Revenue sharing (1): 25% of yield earned on USDs collateral is shared with veSPA holders.

○ Revenue sharing (2): 100% of redemption fees are shared with veSPA holders. USDs yield is ~5% and SPA yield is in range 19%-41% for 1 to 4 years lock ups.

Aren't yield and peg stability add more risk?

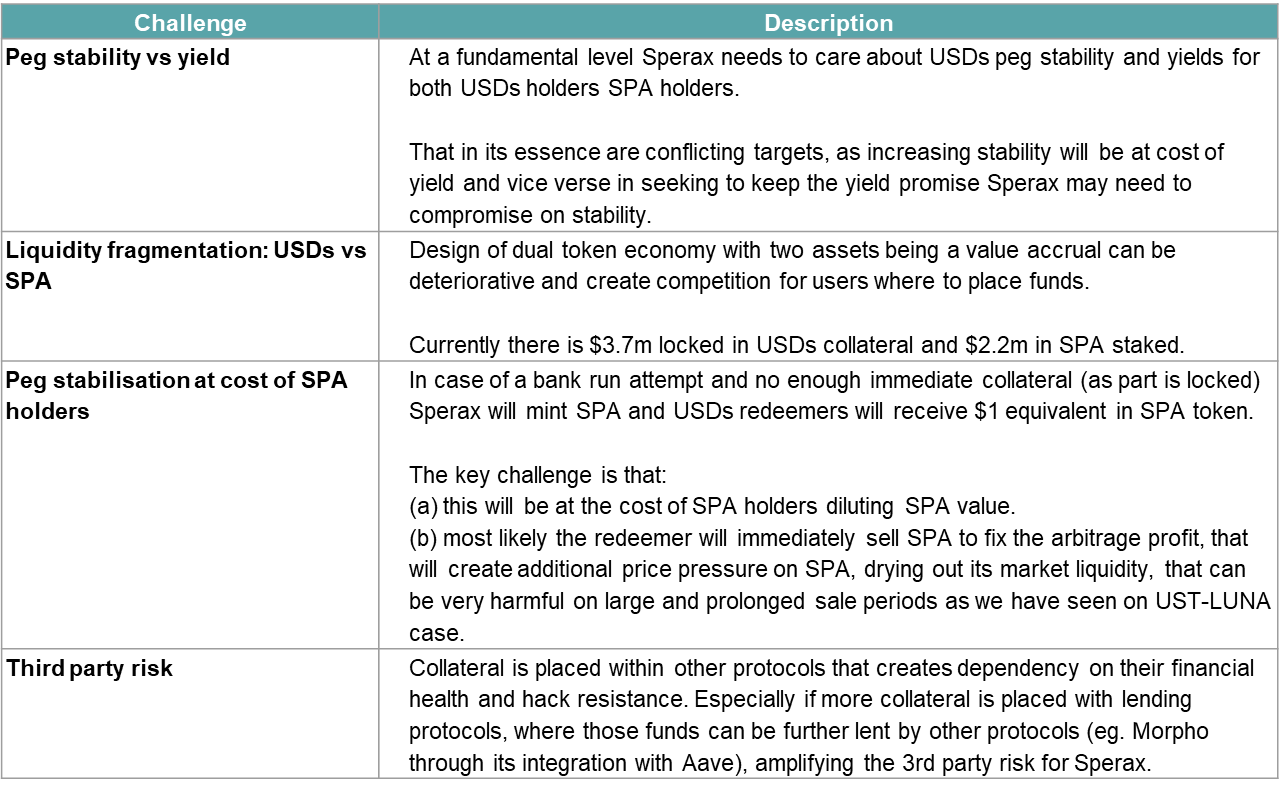

There are number of design challenges driven by duality of the USDs purpose:

Over this year USDs has experienced multiple events of losing the peg and taking it collateral, it can be classified as Group 2 (high risk) under the BIS methodology we have looked at before.

Source: CoinMarketCap

Conclusion

Sperax is an interesting DeFi protocol that aims to give its users not only the benefit of stable means of payment but also the ability to get auto-yield for holding USDs. However there are a number of challenges that Sperax would need to be tested in its ability to balance USDs’ yield vs its stability and balance SPA and USDs communities liquidity and yield.

Got a question for our author regarding this article? Contact him at:

Oleksandr Ulytskyi | Senior Token Economist

E: hello@economicsdesign.com | W: EconomicsDesign.com