Unveiling the Dynamics of DeFi Economics

The concept and math behind DeFi

Introduction

In recent years, the decentralized finance (DeFi) space has emerged as a transformative force in the financial landscape, reshaping traditional systems with blockchain technology and innovative economic models. At Economics Design, we have been closely observing the developments and advancements within the realm of DeFi. In this article, we delve into the fundamental concepts of DeFi and explore the relationship between decentralized finance and token economics.

Key Topics Covered in this Article:

DeFi ≠ Token Economics

Blockchain and its Role in DeFi

DeFi Building Blocks: Unveiling the Layers of Technology

How DeFi Works

Token Types

Token Mechanisms

DeFi Risks

DeFi ≠ Token Economics

While DeFi is often associated with token economics, it is essential to distinguish between the two.

DeFi represents a movement that utilizes decentralized networks to eliminate intermediaries from financial systems, reimagining existing systems with new technology stacks, governance structures, and incentives.

On the other hand, token economics refers to designing and engineering economic models within DeFi systems, encompassing mechanisms that drive value creation, distribution, and sustainability.

Blockchain and its Role in DeFi

To comprehend DeFi's inner workings, it is crucial to grasp the underlying technology that powers it: blockchain.

Blockchain provides the foundation for decentralized finance by ensuring transparency, immutability, and security. DeFi leverages blockchain's capabilities to create trustless, permissionless, auditable financial protocols.

By harnessing the power of blockchain, DeFi protocols are able to provide financial services such as lending, borrowing, trading, and more in a decentralized and open manner. These protocols operate autonomously through smart contracts, which are self-executing agreements with the terms of the agreement directly written into code. Smart contracts enable the automation of financial transactions, removing the need for intermediaries and reducing the associated costs and inefficiencies.

DeFi Building Blocks: Unveiling the Layers of Technology

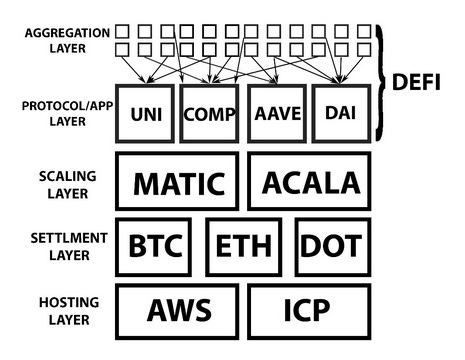

The DeFi ecosystem operates on a multi-layered structure, with each layer playing a distinct role in the overall functionality and efficiency of decentralized finance. Understanding these layers is crucial for comprehending the breadth and depth of the DeFi landscape.

At the base of the DeFi ecosystem lies the settlement layer, which comprises prominent cryptocurrencies like Ethereum (ETH), Polkadot (DOT), Solana (SOL), Binance Coin (BNB), and Bitcoin (BTC). These cryptocurrencies serve as the foundation for financial transactions within the DeFi space, providing a medium of exchange and facilitating the transfer of value between participants.

Moving up the stack, we encounter the application layer, which encompasses a wide array of decentralized applications (DApps) and protocols. This layer is home to non-fungible tokens (NFTs). Additionally, the application layer hosts various decentralized finance protocols that enable lending, borrowing, decentralized exchanges, automated market makers, and more. Payment solutions, gaming platforms, and metaverse projects also fall within this layer.

Sitting atop the application layer is the aggregation layer, which focuses on optimizing the utilization of liquidity across different DeFi protocols. One notable example of the aggregation layer is 1inch, a decentralized exchange aggregator that leverages smart contract technology to offer users the best possible rates by sourcing liquidity from multiple platforms. These yield optimization platforms enhance efficiency and cost-effectiveness by automatically routing trades through various liquidity pools.

By understanding the distinct layers of the DeFi ecosystem, we gain insights into the interconnectedness and interdependence of different components.

How DeFi Works

DeFi operates on three fundamental pillars that drive its functionality and success.

A. Codifying Business Logic with Smart Contracts

DeFi relies on mathematical algorithms and smart contracts to automate financial transactions. At the heart of DeFi is the use of smart contracts, which are self-executing agreements with the terms of the agreement directly written into code.

Smart contracts eliminate the need for intermediaries by automating financial transactions and ensuring that predefined rules and conditions are faithfully executed. In the context of DeFi, smart contracts enable the direct peer-to-peer interaction of users, facilitating transparent and efficient transactions.

By codifying business logic into smart contracts, DeFi protocols can execute various financial operations, such as lending, borrowing, and trading, without relying on centralized authorities. For example, instead of relying on traditional exchanges with order books, DeFi exchanges utilize smart contracts to match buyers and sellers, ensuring trustless and accurate transaction settlement.

B. Distributed governance

Traditional governance structures often face significant challenges, both in the physical and digital realms. Decentralized finance introduces distributed ownership and decision-making models, empowering participants to shape the direction of protocols. Through decentralized governance, stakeholders collectively contribute to the decision-making process, leading to improved efficiency, transparency, and inclusivity.

Through distributed governance mechanisms, such as token voting or consensus mechanisms, DeFi protocols enable a more inclusive and transparent decision-making process. Participants can propose and vote on protocol upgrades, changes to economic parameters, or other governance-related matters. This distributed approach ensures that decisions are made in the best interest of the community and promotes a more resilient and adaptive ecosystem.

C. Incentivizing behaviours

One of the most significant advantages of DeFi is the ability to reallocate incentives to users, redirecting the value captured by intermediaries back to the ecosystem participants. By removing intermediaries and capturing the value that would typically be taken by centralized entities, DeFi protocols can reward users for participating and contributing to the network.

Incentives in DeFi can take various forms, such as token rewards, interest payments, or governance rights. Users are encouraged to provide liquidity to decentralized exchanges, stake their tokens for network security, or actively participate in governance processes. These incentives foster active engagement, innovation, and the growth of the DeFi ecosystem.

Token Types: Governance Tokens, Utility Tokens, and Asset-Backed Tokens

Tokens play a crucial role in DeFi, and they come in various types. There are three primary types of tokens prevalent in the DeFi space: governance tokens, utility tokens, and asset-backed tokens.

A. Governance Tokens

Governance tokens grant holders the power to participate in the decision-making processes of a DeFi protocol. These tokens represent voting rights and governance privileges, allowing token holders to propose and vote on protocol upgrades, changes to parameters, and other governance-related matters.

Governance tokens provide a mechanism for stakeholders to collectively shape the future of the protocol. For example, holders of governance tokens may vote on proposals for new features, changes to tokenomics, or modifications to the protocol's underlying infrastructure. The distribution and use of governance tokens create a more decentralized and inclusive governance model, giving the community a voice in the evolution of the protocol.

B. Utility Tokens

Utility tokens are designed to serve specific functions within a DeFi ecosystem. They provide access rights and validation methods, unlocking various functionalities and services offered by the protocol. Utility tokens are essential for users to interact with and benefit from the decentralized applications (dApps) and services within the DeFi ecosystem.

For instance, utility tokens may grant users access to specific features, discounted transaction fees, or premium services. These tokens act as a medium of exchange within the ecosystem, facilitating seamless transactions and providing users with the necessary tools to leverage the platform's offerings.

C. Asset-Backed Tokens

Asset-backed tokens bridge the gap between traditional and digital finance by representing underlying assets on the blockchain. These tokens are typically backed by real-world assets, such as fiat currencies, commodities, or other financial instruments. Asset-backed tokens provide a means to digitize and tokenize real-world assets, enabling their representation, transfer, and fractional ownership on the blockchain.

An example of an asset-backed token is a stablecoin like DAI, which is backed by a reserve of assets like Ethereum. Each DAI token represents a specific value of the underlying assets, providing stability and liquidity within the DeFi ecosystem. Asset-backed tokens bring transparency, programmability, and accessibility to traditionally illiquid assets, unlocking new opportunities for investors and market participants.

Token Mechanisms: Over Collateralization, Automated Market Makers, and Bonding Curves

Token mechanisms are integral to the functioning of DeFi protocols, employing innovative approaches to ensure stability, liquidity, and efficiency within the ecosystem. We explore three key token mechanisms commonly used in DeFi: over-collateralization, automated market makers (AMMs), and bonding curves.

A. Over Collateralization

Over-collateralization is a risk management technique employed by many DeFi lending and borrowing protocols. It involves requiring users to provide more collateral than the value they wish to access or borrow. This approach ensures the safety and stability of the ecosystem by mitigating the risk of default or under-collateralization.

B. Automated Market Makers (AMMs)

Traditional centralized exchanges rely on order books to match buyers and sellers. In contrast, decentralized exchanges (DEXs) utilize automated market makers (AMMs) to facilitate decentralized trading. AMMs are mathematical algorithms that enable the trading of tokens directly from a liquidity pool without the need for buyers and sellers to interact directly.

AMMs operate on the principle of liquidity pools, which are comprised of users' deposited tokens. These pools utilize smart contracts to provide liquidity and determine token prices based on a mathematical formula. The most commonly used AMM model is the constant product formula, popularized by Uniswap. By using AMMs, users can easily trade tokens while maintaining the liquidity and stability of the market.

C. Bonding Curves

Bonding curves are mathematical mechanisms used for various purposes within DeFi protocols, including fundraising and creating security tokens tied to profit-sharing mechanisms. A bonding curve represents the relationship between the price of a token and its supply. As more tokens are purchased or minted, the price increases according to a predefined formula. This mechanism enables projects to raise funds by minting and selling tokens directly to participants in a decentralized and continuous manner.

DeFi Risks: Technical, Financial, and Economic Considerations

As with any financial ecosystem, DeFi is not without its risks. It is crucial for participants to be aware of and actively manage these risks to ensure the security and stability of their investments.

A. Technical Risks

Technical risks pertain to vulnerabilities in smart contracts and the underlying technology that powers DeFi protocols. Smart contracts are self-executing contracts with the terms of the agreement directly written into code. While smart contracts enhance efficiency and automation, they are not immune to bugs or coding errors. Exploiting these vulnerabilities can lead to financial losses or other security breaches.

It is essential for developers and users to conduct thorough security audits, implement best practices in coding, and remain vigilant in detecting and addressing potential vulnerabilities. Additionally, the community's proactive engagement in identifying and reporting bugs can help maintain the integrity of the DeFi ecosystem.

B. Financial Risks

Financial risks within DeFi primarily revolve around the volatility of token prices and the potential for over-leveraging. The value of tokens in DeFi can be highly volatile, subject to market forces, speculation, and other external factors. Participants must be prepared for the possibility of substantial price fluctuations, which can impact their trade positions or the value of their holdings.

C. Economic Risks

Economic risks in DeFi arise from potential exploitations or unintended consequences within the ecosystem. As DeFi protocols and mechanisms grow in complexity, they can become targets for malicious actors seeking to exploit vulnerabilities for personal gain. For example, an exploit in a lending protocol could result in funds being drained or manipulated.

Unintended consequences can also occur due to the interconnected nature of DeFi protocols. Changes or updates in one protocol can have unintended effects on other protocols, leading to unforeseen economic outcomes. This emphasizes the importance of rigorous testing, audits, and ongoing monitoring to identify and address any potential risks or vulnerabilities.

Conclusion

In conclusion, the future of DeFi is undeniably exciting. By leveraging blockchain technology, codifying business logic through smart contracts, embracing distributed governance, and incentivizing behaviors, DeFi opens up a world of possibilities for financial innovation and inclusion.

While it is important to acknowledge and mitigate the risks associated with DeFi, the overall trajectory points towards a decentralized financial landscape that is more accessible, efficient, and transparent. As we continue to witness advancements in DeFi protocols and the development of novel token mechanisms, the potential for economic empowerment and collaborative growth becomes increasingly evident.

With informed decision-making, responsible participation, and continuous adaptation, we can collectively shape the future of DeFi and unlock its full potential for the benefit of all.

The team at Economics Design offers tokenomics consultancy and advanced Token Economics courses for aspiring economists looking for advanced assistance with token economics design and token engineering. Stay informed and stay safe by subscribing to our newsletter for the latest insights and updates on DeFi and token economics.