A DECENTRALISED LENDING PROTOCOL - MAKERDAO

Welcome to all our free subscribers. What will be shared today are free alpha from our Economics Design's researchers.Introduction

Quick background what is MakerDAO

MakerDAO is a lending platform, that powers a decentralised stablecoin DAI. DAI is soft-pegged to the USD.

The protocol works by allowing anyone to take out loans in DAI using other cryptocurrencies as collateral. These loans are overcollateralised, meaning that borrower needs to deposit more cryptocurrency (eg. ETH) in USD value than DAI loan.

The use of such loans is further to place DAI into yield farming opportunities, while not selling own ETH.

Protocol revenue:

Interest – upon withdrawal of collateral users returns DAI+ accrued stability fee that is immediately used to buy back MKR tokens.

Liquidation penalties – in case loan breaches collaterisation rate it is liquidated and in addition to interest user is charged liquidation penalty that is as well used to buy back MKR.

Messari.io started financial reporting coverage for MakerDAO, let's dive in to it.

MakerDAO PL Q3-22: loss making, first since 2020. Q4-22 will be most likely negative as well.

MakerDAO PL

Interest revenue is on a decline pass. Since Q1-22, dropping to $4.0m in Q3-22 vs $11.7m same quarter last year and $12.3m in Q2-22. There is less demand for loans.

Liquidation revenue smoothed declining interest revenues in H1-22: H1-22 has been a great deleveraging fueled by Terra-Luna collapse that generated whopping $40.4m of revenue over that period, outpacing interest rate revenue of $35.3m for the same period.

Liquidation revenue looks as a material component of the inflows for the protocol in the last twelve month (LTM) 39% of revenue came from liquidations.

This raises a thinking on a design risk, as protocol is interested in liquidations as a faucet of quick and large revenues.

Expenses picked up in 2022. Are fixed in nature: Material acceleration since Q1 2022, Q3-22 landed at $13.5m vs $5.8m same quarter last year.

No details in the Messari report, but based on makerburn.com there most material item is Oracle Unit. Per budget request there has been expected increase of the oracle team from 6 FTE to 15.5 FTE that was budgeted at $5m. Per makerburn.com there has been $10m spent on Oracle Team over 9 months 2022, the next large spend is Protocol Engineering $6.3m for 9 months 2022.

Bottom line: MakerDAO has seen a loss in Q3-22 at ($9.4m). According to Cointelegraph this the a first loss making quarter since 2020.

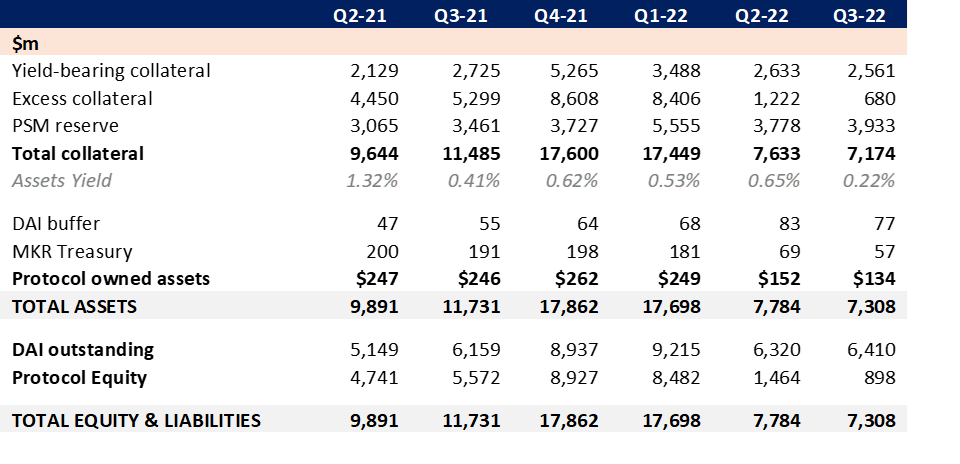

MakerDAO Balance Sheet

**This is not an investment or financial advise.**

What else did you miss?

Segwaying into TradeFi

Closing thoughts

Get premium access to unlock more content. If you already have a premium subscription with us, click here to view the full article.

Got a question for our author regarding this article? Contact him at:

Oleksandr Ulytskyi | Senior Token Economist

E: hello@economicsdesign.com | W: EconomicsDesign.com